It’s Time to Prepare for Medicare Advantage Provider Network Submissions

Network management, directory accuracy, initial applications, service area expansions (SAEs), and the new triennial review process have exposed many Medicare Advantage (MA) plans to serious issues—from policy to process and staffing to technology. As we move into the countdown for network development, expansion, and Health Service Delivery (HSD) submission for 2020, as well as plan years 2021 and 2022, it is imperative for network strategy planning to start now in order to avoid the pitfalls plans have faced with the new regulatory guidance.

In previous years, plans submitted HSD tables along with applications. By the end of April, there was clear insight into which counties the Centers for Medicare & Medicaid Services (CMS) deemed to have an adequate network, allowing product teams to quickly move forward with the product development process.

With the timeline changes, bids are submitted prior to HSD tables being uploaded and reviewed by CMS. This requires plans to implement internal deadlines for the contracting process and decide whether to file a county on the edge of meeting network adequacy. The extra time and latitude offered by CMS in the network submission process resulted in additional contracting time; however, at the same time, this has exposed the increasing importance for strong network management that blends network and product strategy, as well as firm internal timelines for network expansion.

For example, last year, we saw plans suppressed from Plan Finder during the Annual Enrollment Period (AEP) due to unresolved network deficiencies. The resulting loss of anticipated membership that was budgeted for AEP became a last-minute challenge for sales and marketing, and a reset on the plan budget process.

Additionally, as MA plans gain greater flexibility in designing and offering new types of benefits to members, blending network and product strategies becomes critical. When evaluating the impact a variety of supplemental benefits could have on sales and marketing strategy, especially when addressing the social determinates of health (SDOH) that most impact your geographic area and member population, we begin to see a vast gap in the playing field—from plans sticking to the basics with meals and non-emergent transport to plans willing to invest in innovative benefit options without knowing the exact return on investment a benefit will have on patient outcomes or financial upside/downside cost.

With these changes and supplemental benefits flexibility, we may see an upswing in strategic partnerships to improve member experience, including:

- Post-acute providers, such as transitional assisted living and skilled nursing facilities

- Vendors offering adaptive aids to keep patients at home longer

- Meal or grocery delivery services

- Resources to expand transportation services

From a provider network perspective, the move toward new partnerships will likely present a few stumbling blocks, such as how to code and pay for services, and require a ramp-up period we do not see with traditional MA providers. We encourage plans to start early and break down silos by having group discussions that include Sales & Marketing, Medical Management, Star Ratings, Operations, Credentialing and Provider Network departments to design a holistic strategy. These new, non-traditional providers will likely be dipping toes in the same deep end of the pool; extra lead time and planning will serve you well across the board.

For non-traditional providers, we would encourage all MA plans to have:

- Planned education sessions/town hall meetings to educate new vendors/providers and better understand their needs

- A plan for a lengthier contracting and credentialing process

- A plan for additional onboarding and training with the new vendors

- Additional member education time

Moving forward, as you internalize the new contracting timeline to include standard MA providers as well as any new, non-traditional supplemental benefit providers, communication and oversight will be key. This is especially important when managing provider network contracting and credentialing data, particularly when using outside sources to assist in contracting or a credentialing verification organization (CVO) to manage the initial credentialing process. Ultimately, the plan is responsible and held accountable for the compliance of the contracting and credentialing of its provider networks. Plans submitting initial and SAE applications should work backwards from the mid-June submission date and develop an actionable deadline(s) to ensure the network submitted meets CMS network adequacy requirements.

What Should Medicare Advantage Plans Do?

Step one in any timeline is preparing a solid network strategy. In today’s marketplace, it is no longer acceptable to meet the bare minimum of network requirements. Consumers (and CMS) are demanding plan choices that include quality and cost efficiency as well as supplemental benefits.

Even further, with consumer-savvy, newly aged-in Medicare beneficiaries, there is a shift in patient expectations of the services available for their dollar. The new beneficiary is aging into a world of patient engagement and incentive/reward programs but will expect the same level of service. Plans need to find ways to evaluate existing provider networks and newly expanded networks to meet clinical and financial goals.

As you start your initial or expansion planning process and set new network monitoring processes in place to ensure preparedness, we’re here to help. Gorman Health Group has a long history of:

- Leveraging long-standing relationships and nationwide experience coupled with a cost-effective team of senior consultants and network analysts to effectively and efficiently stand up a contracted provider network

- Designing and developing network and product strategies that take into account the quality, financial, risk adjustment, and Star Ratings goals critical to success within the competitive landscape of your market(s)

- Developing the oversight and monitoring P&Ps needed to address the new network and directory requirements

- Developing a network to support a competitive supplemental benefit program

- Preparing plans’ HSD tables for a CMS filing or bid submission as well as preparing network exceptions to include all the required elements

Let us know how we can work together now to support your plan’s goals for the upcoming submission and plan year. Contact Elena Martin at emartin@ghgadvisors.com.

Parts C & D Enrollee Grievances, Organization/Coverage Determinations, and Appeals Guidance

On December 30, 2019, the Centers for Medicare & Medicaid Services (CMS) announced updates to the Parts C & D Enrollee Grievance, Organization/Coverage Determination and Appeals Guidance, which became effective as of January 1, 2020. Noteworthy changes are summarized below:

- In Section 10.5.3, the guidance was expanded to include more detail about verbal notifications. This section details when and under what circumstances the verbal notification is considered delivered, what defines a successful verbal notification (e.g., speaking with the person that submitted the request or leaving a voicemail message), and the appropriate steps to take if written notice is required along with verbal notification. CMS also deleted subsection 10.5.4: Good Faith Effort to Provide Verbal Notification, which was a new section introduced in the February 2019 version of the Guidance. There is a notable revision to guidance for a favorable decision that a plan “may” deliver written confirmation of its decision after initially providing verbal notification of the decision. This is a change from the 2019 guidance indicating the plan “must” deliver written notification. (See updated Section 40.8.)

- Throughout the Parts C & D Guidance, CMS revised existing requirements to now include Part B Drugs.

- Section 40 (Coverage Determinations, Organization Determinations [Initial Determinations] and At-Risk Determinations) has several significant updates:

- There is a more detailed description of the process for requesting a Part C pre-service organization determination or Prior Authorization (PA). CMS provides clarification that Medicare Advantage (MA) plans should be prepared to address medical necessity as required in these scenarios. (See Section 40.1.)

- There is a new Part D provision that applies to circumstances where a plan is asked to waive a PA or other Utilization Management requirement. Updated language provides for tolling of the timeframe by up to 14 calendar days after the receipt of a request to receive the supporting statement. (See Sections 40.4 and 40.5.3.)

- Also noted are new Part D notification timeframes surrounding Exception Requests. In previous guidance, plans were instructed not to keep requests for supporting statements open indefinitely. This language is deleted in the updated guidance, and in its place, CMS outlines specific new timeframes for enrollee and prescribing physician (as appropriate) notification of plan decisions for both expedited and standard requests, and includes notification timeframes for circumstances when the supporting statement is not received with the 14 calendar day timeframe.

- CMS has included Part B Drugs in the decision timeframes (favorable, partially favorable, or adverse) as well as processing timeframes (72 hours for standard requests for Part B Drugs and 24 hours for expedited). CMS also clarified that requests for Part B Drugs and payment timeframes cannot be extended.

- Section 50 Reconsiderations and Redeterminations (Level 1 Appeals) contains a number of updated clarifications to existing requirements. Most noteworthy changes are the provisions for adjudication timeframes for Part B Drugs.

- CMS clarifies Health Care Pre-Payment Plans (HCPPs) are not regulated by Section 100 (Provider Notices in Hospital, SNF, HHA and CORF Settings [Part C Only]) and clarifies that HCPP enrollees must follow Original Medicare immediate review processes.

- The Medicare Managed Care Appeals Process Overview for Part C (Appendix 1) is amended to include timeframes for Part B Drugs in both the standard and expedited processes. Also, for both Parts C and D Process Overviews, the “Amount in Controversy” (AIC) is increased to $170 at the Administrative Law Judge (ALJ) Hearing stage. The AIC is also increased at the Federal District Court stage to $1,670.

Plans should carefully review the

updates and incorporate the numerous changes to existing plan policy.

GHG assists plans in implementing process improvements in relation to new CMS requirements. We also conduct assessments and mock audits to validate adherence. Contact us today for additional information.

The OEP Is Almost Upon US! Are YOU Ready?

January 1, 2020,

Medicare Advantage (MA) enrollees have a one-time opportunity to switch their

plan, similar to a grace period, and the opportunity ends March 31. Both new MA

enrollees and existing enrollees have the ability to switch plans. This is a

chance for MA plans to win and lose enrollment! To make sure you are not on the

losing enrollment side, here are a few ideas in which to invest resources and

budget before the upcoming Open Enrollment Period (OEP). Per the Deft research

2019 OEP study, “Almost 75% of the OEP

switchers had also switched during AEP!”

GHG expects to see more movement during OEP this year as Medicare

beneficiaries are more aware of the opportunity.

Member

Services and Member Communications Need to Be the Stars of OEP!

Member communication

interactions (either verbal, written, or in person) could either break or win

you the OEP. You still have time to review your welcome interactions with both

new and existing members to ensure they are best in class. You may want to have

member events this year so new and existing members understand the 2020

benefits – and if you have great news for them, you want to make sure they hear

it.

The goal is to ensure

every new member knows what to do January 1 and to have multiple touches that

educate, welcome, and engage members about their new MA plan. The earlier you

start this process, the better. You do not want buyer’s remorse occurring at

any point from the sale through the end of OEP. Existing members need to be

educated about any changes in benefits, and if your data is talking to you, you

will have a list of members who need “real” hands-on member service touch points.

Basic awareness of

online portals and any mobile apps offered by the plan also correlate strongly

to plan loyalty. Loyal members are more likely to participate in plan wellness

programs, which can help with cost containment and utilization.

In addition, when was the last time you really looked at

the communications going to your members?

- Are

you communicating too much or not enough? - Do

the communications have the same tone and messaging throughout? Or are they

just recycled from year to year? - Has

the Member Services team received training lately to make sure they are

reinforcing the tone and messaging you want your members to hear and feel? - Do

they know the 2020 benefits and what benefits to make sure members know about? - Do

you listen to Member Services calls to ensure you are providing the member

experience you portray in your advertising and communications? - Do

you take member feedback into account in designing member materials?

Usefulness of member

materials in regards to understanding coverage and benefits is strongly

associated with loyalty. Now is the time to reassess how you are communicating

with your members and make certain you are maximizing your opportunity.

Marketing

Cannot Be Forgotten

Health plans are unable to market the OEP opportunity but

do have the ability to market the following:

- Branding

- New

to Medicare - Education

Although you may not

have much of a budget for marketing during the first quarter, you can utilize

it effectively. Make sure you are advertising in January and the last few weeks

of March. If you have educational events, advertising them digitally or though

radio will help bring additional awareness to what your organization does for

its members. Most plans have a very robust “New to Medicare” budget already, but

you may want to invest in some freestanding inserts in January or March, amp up

your digital advertising, and/or advertise on TV. Utilize branding during this

time since it puts your name in the market during the OEP. Whatever you have

the resources to do, make sure you are strategic in your efforts to make it

worthwhile.

It Is

Not All About Winning Enrollment

At Gorman Health Group, we are hearing many clients talk about gaining enrollment during the OEP but not so much about the possibility of losing membership. Your goal should be to ensure you have everything in place for this OEP to make certain you are on the winning side of OEP and are not giving up your membership to another MA plan that made sure they strategically invested in this opportunity!

For more information about the OEP opportunity and ways you can set up your team for success, contact us at dhollie@ghgadvisors.com or rdesai@ghgadvisors.com

2020 Readiness Checklist

On October 3, 2019 the Centers

for Medicare & Medicaid Services (CMS) released the 2020 Readiness

Checklist highlighting critical operational and contractual requirements for

Medicare Advantage Organizations (MAOs), Prescription Drug Plans (PDPs),

Medicare-Medicaid Plans (MMPs), and Cost Plans.

The readiness checklist is released annually and, when used as a

“self-assessment,” can be an effective tool for validating organizational

compliance with Annual Election Period (AEP) and 2020 plan coverage requirements. With this self-assessment, the organization

will have both a working knowledge of their state of readiness as well as a roadmap

for process improvements. It’s important

to note that organizations are required to identify risks and notify their CMS account

manager(s) and should anticipate follow-up discussions on those areas of focus.

Plan Sponsors should carefully

review the checklist for regulatory changes and updates that may have occurred

since the 2019 checklist’s release. Remember,

this checklist is intended as a summary of the critical requirements. Plans should refer to all new guidance,

memos, Final Rules, and the Call Letter for the detailed interpretation of CMS

requirements.

A few examples of focus areas that may be new or expanded

for 2020 include:

- Precluded

Providers and Prescribers - For 2020 CMS has expanded on the expectations

for managing precluded providers and prescribers. In addition to requiring beneficiary notices:

MAOs/Part D Sponsors must deny payments for a health care item or service,

reject the pharmacy claim, or deny the beneficiary request for reimbursement

when the prescribing individual is on the Preclusion List. - Timeframes

for adjudicating Part B Drug Requests – The Medicare Advantage (MA) and

Part D Drug Pricing Final Rule (CMS-4180-F) issued in May 2019 introduced new,

shortened adjudication timeframes for Part B drugs. MAOs must ensure requests

are adjudicated and favorable decisions are effectuated in accordance with the

new guidelines. - Medicare

Plan Finder Data (MPF) – For 2020 Part D Sponsors should ensure access to

the Health Plan Management System (HPMS) Part D Pricing File Submission Module

for both Part D pricing file submission and quality assurance (QA) validation

results. The updates and announcements

previously available on the MPF Communications Website are now posted in the

module’s Documentation section. - Medicare

Marketing - Updates to the Medicare Communications and Marketing Guidelines

(MCMG) will impact marketing and communication materials and activities. Plan

Sponsors must ensure the respective materials comply with the most current

guidance. - Prescription

Drug Event (PDE) Requirements – Part D Sponsors must ensure submission of

data and information necessary for CMS to carry out payment provisions are

submitted through the Prescription Drug Front-End System (PDFS) and processed

by the Drug Data Processing System (DDPS).

Details about what is required to become certified to submit data, along

with guidance on data submission and other resources, is available on the

Customer Service Support Center (CSSC) website. - Coverage

Gap Discount Program (CGDP) – CMS expects Part D Sponsors to be familiar

with their responsibilities to participate in the CGDP, and provides

information about the CGDP portal, onboarding training and CGDP Portal Sponsor

User Guides available from the TPAdministrator.com website in the Reference

section.

GHG conducts readiness assessments for its clients to help identify any areas of risk related to upcoming plan year preparedness. This is especially important for Plans new to the market in 2020. Contact us today for additional information.

Blending Network Strategy & Product Strategy

As more and more health systems and provider organizations successfully manage the shift from volume-based patient care to value-based population health management, health plan strategic planning should be blending network strategy with product strategy as a key factor in the ability to achieve clinical and financial goals. The majority of providers are savvy at managing pay-for-performance and upside risk arrangements and, as providers have seen their margins narrow and plateau, they are more willing to step out into more advanced risk-sharing deals, plans have had to adapt and move beyond simple incentivizing for behavior change. Systems that have ventured into managing downside risk and percent of premium arrangements and have been successful have an appetite for more. Certainly, moving up the food chain from a provider to a payer has been a topic of conversation among Chief Executive Officers of large integrated delivery systems. They have worked hard to align referral networks and build physician trust, develop relationships with diverse community support organizations, forge a strong brand recognition in their local communities, and negotiate contracts with health plans that have met and exceeded care and cost containment goals.

Historically, health plans have based a large majority of their decisions regarding expansion areas on the financial feasibility of the markets. Understanding the desire and direction of health systems in general coupled with the alliances plans have worked hard to develop in their current markets, the trend has been to include a network assessment as part of the new market feasibility. Knowing the local players, their appetite for risk, hospital alliances, the Accountable Care Organizations (ACOs) in the market, along with modeling the potential partners against Centers for Medicare & Medicaid Services (CMS) network adequacy standards, can play a significant part in the success or failure in any expansion market.

As we have met and strategized with

provider systems from their baby steps into pay-for-performance incentives to

negotiating their first risk deal, there has been, and still is, a strong

reliance on health plans to set clinical pathways and benchmarks. From the

provider perspective, the reporting, transparency and willingness to share in

the financial successes with the plan partners, is a key consideration in who

to collaborate with. Systems are starting

to explore the administrative support organizations available and realize stepping

out to become their own health plan doesn’t seem as scary as it may have five

years ago. From the plan perspective, the need to partner with providers and

health systems with a depth of understanding in risk adjustment and Stars along

with the clinical skill set, and often non-clinical support services, to truly

provide a holistic approach to patient care has never been more critical to

success. The directive for potential new

network adequacy requirements and more tele-health options will allow room for

plans to become even more innovative with their benefits. The ability to blend

network strategy and product strategy will likely be evident of how successful plans

are.

For plans and providers, knowing

your local healthcare market, who the key stakeholders are, and keeping open

communication will be paramount to the development of a strategy that puts you

ahead of your competition.

Three Ways to Retain Your Members for 2020

It’s the Annual Election Period (AEP) and now

is a really difficult time to turn your thoughts away from what’s right in

front of you, but a strong retention program can be the difference between

achieving your enrollment goals or missing them. Member retention is key to long-term

success. Net growth does not happen with

new sales alone, but with a careful balance between new sales and the retention

of members once they have enrolled. The

following are three recommendations to help you think through opportunities for

your retention plan.

- Onboarding new members and developing a year-long engagement strategy is crucial today. Per the Deft research 2019 (Open Enrollment Period) OEP study “Almost 75% of the OEP switchers had also switched during AEP!” And GHG expects to see more movement during OEP this year as Medicare beneficiaries are more aware of the opportunity. Developing a structured onboarding strategy that begins with the agent (whether it is a sales agent or telephone representative) is important. In addition, developing a Welcome package and Welcome calls that occur well before the new member is accessing benefits is important. During these communications, you need to capture how each member wants to be communicated with going forward to find the best way to interact on a one-to-one basis.

Today there are multiple benefits (all with different rules and access points) that are offered by vendors and not the health plan which can cause confusion. This doesn’t include the plan rules, provider issues, and the complexity of some of the pharmacy benefits offered today. Developing a year-long multi-channel education strategy for new members is key to engagement. This strategy should be more heavily weighted to the first three months during the OEP.

DOWNLOAD YOUR 2020 AEP SALES AND MARKETING CHECKLIST HERE

- Many times GHG asks the question “How do you educate members about new benefits, especially new additions to the Plan or decreases in premium and copays?” In most cases the response is the Annual Notice of Change (ANOC). GHG considers this a government document not a member communication. While there is advertising to increase membership, many times the effort is not made to let members know what you are doing for them. Communicating to your members about what you do right and the improvements you are making to benefits, premiums, providers, and even better operational improvements can help the member to ignore the AEP or be persuaded by agents or the advertising in the marketplace. Many times this can be done by a variety of touch points such as outbound phone calls, newsletters, emails, your website, member meetings, or digitally to make sure the member has reinforcement in a variety of different communication channels.

- Developing a specific retention strategy to target those most likely to leave. Typically, we know those who are in a Medicare Advantage (MA) plan less than three years and members with the little to no utilization or engagement are most likely to leave, but does that hold up for your MA plan? Profiling members most likely to leave and investing in a retention strategy to engage these members will more than pay for itself. Also, it is important to measure this and understand what the potential return on investment is for these efforts. As budgets are constantly under scrutiny, you need to understand what these investments in retention save you in the long run.

These are just three tips to get you started on your way to increasing membership, just by keeping the members you have! If you have questions or want more information about how you can develop a member retention or engagement strategy reach out to me at dhollie@ghgadvisors.com or call me at 215-499-1417. Call today – it is not too late to get this done before 2020!

New Membership Preparation From a Clinical Perspective

How do plans get ready for new membership as the new

enrollment period starts?

When you are trying to plan for the future at times it is

best to look back at the past….past data, past experiences, trends and your past

mistakes as well.

As AEP rolls around it’s time to look back at the clinical

picture of plan year 2018 data. If you are keeping the same service areas, or

if you are entering counties with like populations, what did your last plan

year’s data tell you? Did you anticipate the population attributes that contributed

to increased utilization costs?

One exercise to consider is to isolate all of the members

who were new to your plan last year, by county, and look back at their

inpatient, pharmacy and outpatient specialty physician use. Then take this data

and categorize by disease state or diagnosis, age/gender bands and plan type.

Consider to then ask the following questions:

- Did we analyze, on a first quarter/monthly

basis, the new Rx fills for this new membership for clues to the member early

care management intervention? - Did the care management team reach out to and

successfully engage the member in care management strategies? - Did the care management team identify any

additional information that could have been beneficial for prevention of

hospital admissions and if so, how was the information used to influence member

behavior? Was the information shared

with the PCP? ? (hopefully to the PCP) - Was the comprehensive medication review conducted

timely and did the review reveal new care management clues? - Did we see patterns of underutilization on the

provider side based upon the type of prescriptions filled? - Did we see a member with high utilization of a

specialty provider without establishing a PCP?

Taking into consideration your past plan year data trends,

especially with similar populations in the same service area/subsidy

classification and benefit structures can give you clues of what may be in your

future for managing new members from a

clinical program perspective.

If you have the opportunity to use a tool that prospectively

predicts social determinant of health attributes based upon consumer behaviors,

this will be a great data overlay to the above.

Many plans miss opportunities with new members because,

well, they are new and if they don’t hit the hospital doors or have high claims

volume early on, they stay on the outside of what care support or interventions

are possible to manage their care. To

help prepare for the upcoming year, we recommend that plans start analyzing

member information early on, and then ongoing to identify ways the plan can

help members use the benefits and network to their benefit and your cost

savings.

In the Midst of AEP…Don’t Lose Sight of the Upcoming Application Season Compliance Solutions

In

mid-October, CMS will release the online Calendar Year 2021 Notice of Intent to

Apply (NOIA). The NOIA must be submitted

to CMS by November 12, 2019 if organizations plan to submit an application for

the 2021 plan year, either for a new contract or contract expansion, including

the following:

It’s

that time again…time to begin marketing for the upcoming plan year and prepare

for sales and enrollment activities during the Annual Election Period

(AEP). With all that entails, it can be

easy to forget about other upcoming important dates on the Centers for Medicare

and Medicaid Services (CMS) calendar.

- New Medicare

Advantage (MA) or Prescription Drug Benefit (Part D) contract - Offering a new

product type - Expanding the

service area - Adding

prescription drug benefits (Part D) to an existing contract

How

can organizations be best prepared? It’s

not too late to conduct a feasibility study to assist in the ‘go/no-go’

decision. A network analysis should also

be completed to determine any potential adequacy issues or gaps. Remember that filing the NOIA with CMS only

informs them of the Organization’s intent to apply, it does not require that a

formal application be submitted.

Gorman Health Group can assist in all phases of the application process including the feasibility study, network analysis, and application completion/submission. We have a long history of successful submissions and support. Contact us today to discuss how we can best support your Organization.

GHG cannot only assist with your application filing but can also project manage the entire process? Contact us today for more information.

The Medicare Plan Finder (MPF) Tool AND its Much Needed Make-over

Starting this AEP Medicare beneficiaries will have a new experience when researching Medicare Plans on medicare.gov. The site is much more user friendly and provides a much cleaner user experience. The picture below displays the new home page you will see when you enter the site.

It’s hard to

believe that the original MPF, one of the most widely visited tools for

Medicare Beneficiaries, is ten years old.

In that time, the functionality, look and user experience has pretty

much remained unchanged.

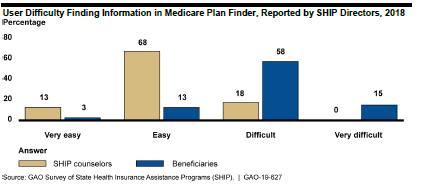

GAO Findings

The Government

Accountability Office (GAO) completed a study in July 2019 and found that the MPF

was difficult for beneficiaries to navigate and it provided incomplete

information. It also stated that beneficiaries struggle with using the MPF

because it can be difficult to find information on the website and the

information can be hard to understand. For example, MPF:

- Requires

navigation through multiple pages before displaying plan details, - Lacks

prominent instructions to help find information, and - Contains

complex terms that make it difficult to understand information.

In response to

a GAO’s survey, 73 percent of SHIP directors reported that beneficiaries

experience difficulty finding information in MPF, while 18 percent reported

that SHIP counselors experience difficulty.

New and Improved MPF

CMS has

redesigned the MPF site to tackle the problems raised above and from first

glance (the CMS training and the new MPF view online) it appears that CMS has

greatly improved the navigation and ability to find information. CMS conducted intensive rounds of consumer

testing, took information from multiple reports and recommendations from web

design experts to develop the new look, feel and navigation.

Beneficiaries

still have the option to go on the site as a blind user or to sign into the

site. For Medicare beneficiaries who

sign into the site and create an account there are a couple of very

personalized experiences that are only available if you create an account.

- When

it brings up drugs, the site will populate the drugs that are on file that

beneficiary is known to have taken. The

beneficiary will have the opportunity to accept all of the drugs or to add or

delete drugs to the list. This will help

personalize their estimated drug costs. - You

have the opportunity to utilize a live chat feature that will take you real

time to a representative from 1-800-Medicare who can help the beneficiary with

their questions.

Even if you

don’t sign in there are still really great new features:

- You

can now select three pharmacies instead of two when you are asked to select

pharmacies. - Before

you could only compare two Plans for MA and PDP plans, now you can compare

three plans - There

are new filters for selection such as star rating, company, different supplemental benefits (wellness,

vision, dental, hearing, transportation and fitness benefits), covers all the

drugs on the beneficiary’s drug list - The

plan details is much more inclusive with many of the supplemental benefits

including those that apply only to beneficiaries with chronic conditions

Medicare

beneficiaries and agents who utilize this for their clients will definitely see

a great improvement but there is still room for a better experience for

beneficiaries. Some of the immediate

ones we noticed were:

- The

ability to see if the beneficiary’s doctor is in the network – this is one CMS

is looking to tackle soon - Medicare

Supplement premiums – there is still a range of premium but CMS is hoping to

get better data to fix this issue. - With

many of the new supplemental benefits it only states whether they are covered

or not but does not show the benefit detail, such as cost-sharing and

limitations. This still does not provide beneficiaries with all the

information they need to make the best decision.

Overall it is a

great next step. Go on the site now to

get a look. Up until AEP, you see the

old site but can access the new site.

Once AEP arrives you will only be able to see the new and improved MPF.

Feasibility Studies

Two

of the most common questions plans ask are: “Where should we be offering

products?” and “What products should we be offering?” A feasibility study can

really help make that picture clearer. For plans looking to either expand or

become a health plan in 2021, this should be done as early in the process as

possible.

Some

of the top reasons to conduct a feasibility study include:

- Getting

a more complete understanding of whether service areas are financially viable, show

membership growth potential, or both - Getting

an understanding of how existing operations and performance can impact revenue

and margins and vice versa - Getting

an understanding of the sensitivity of various factors that have a large impact

on margin

When

looking at service areas, benchmarks and factors that play into the

maximization of benchmarks are very important. How are benchmark rates trending

from year to year? Does the pre-Affordable Care Act (ACA) rate limit growth? Do

pre-ACA rates limit the amount of bonus for new plans and plans that achieve

the 5% bonus? Do any areas qualify for the double bonus? Is there any upcoming

legislation that may impact payment rates?

For

membership potential, a thorough study of the markets being considered must

occur. How many health plans and products are available? What is the growth in the

number of beneficiaries joining Medicare Advantage (MA) plans? How much of the

population is aging in? What types of plans are growing membership? Do I have

existing populations through individual commercial or group pIans to whom I can

market? Can I co-brand with a provider group or hospital system?

Your

existing operations and performance can also play a large role. What kind of “lift”

will it take to build my network? Are there any risk arrangements? Will I need

a new Centers for Medicare & Medicaid Services (CMS) contract? What amount

of effort will it take with my existing systems to add a new service area or

product? How is medical management on my current population? Will my Star

Ratings positively or negatively impact the benchmarks used? If I’m not already

in MA, what kind of lift will it take, and what will it cost?

Completing

a feasibility study and conducting a sensitivity analyses can really help plans

make these decisions. For new plans, it is important to know just how sensitive

certain factors can be. These factors include provider contracting and expected

improvement in contracting rates, utilization management relative to Fee for Service

and how much improvement there will be from year to year, risk adjustment trends,

Star Ratings, administrative costs and trends, and membership. CMS expects

plans to have a positive margin by the fifth year of business. Conducting the

feasibility study and sensitivity analyses can help plans understand what has

to go right in order achieve a positive margin.

At Gorman Health Group, we have provided expertise to

government-sponsored plans in conducting feasibility studies. We have extensive

experience in the bid process as well as forecasting. Feel free to reach out

and discuss how we can assist you in developing a feasibility study for any

markets and products in which you may be interested.