The Medicare Plan Finder (MPF) Tool AND its Much Needed Make-over

Starting this AEP Medicare beneficiaries will have a new experience when researching Medicare Plans on medicare.gov. The site is much more user friendly and provides a much cleaner user experience. The picture below displays the new home page you will see when you enter the site.

It’s hard to

believe that the original MPF, one of the most widely visited tools for

Medicare Beneficiaries, is ten years old.

In that time, the functionality, look and user experience has pretty

much remained unchanged.

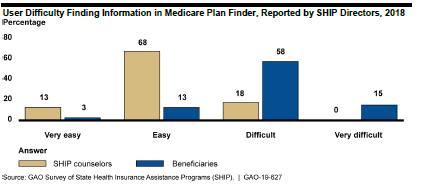

GAO Findings

The Government

Accountability Office (GAO) completed a study in July 2019 and found that the MPF

was difficult for beneficiaries to navigate and it provided incomplete

information. It also stated that beneficiaries struggle with using the MPF

because it can be difficult to find information on the website and the

information can be hard to understand. For example, MPF:

- Requires

navigation through multiple pages before displaying plan details, - Lacks

prominent instructions to help find information, and - Contains

complex terms that make it difficult to understand information.

In response to

a GAO’s survey, 73 percent of SHIP directors reported that beneficiaries

experience difficulty finding information in MPF, while 18 percent reported

that SHIP counselors experience difficulty.

New and Improved MPF

CMS has

redesigned the MPF site to tackle the problems raised above and from first

glance (the CMS training and the new MPF view online) it appears that CMS has

greatly improved the navigation and ability to find information. CMS conducted intensive rounds of consumer

testing, took information from multiple reports and recommendations from web

design experts to develop the new look, feel and navigation.

Beneficiaries

still have the option to go on the site as a blind user or to sign into the

site. For Medicare beneficiaries who

sign into the site and create an account there are a couple of very

personalized experiences that are only available if you create an account.

- When

it brings up drugs, the site will populate the drugs that are on file that

beneficiary is known to have taken. The

beneficiary will have the opportunity to accept all of the drugs or to add or

delete drugs to the list. This will help

personalize their estimated drug costs. - You

have the opportunity to utilize a live chat feature that will take you real

time to a representative from 1-800-Medicare who can help the beneficiary with

their questions.

Even if you

don’t sign in there are still really great new features:

- You

can now select three pharmacies instead of two when you are asked to select

pharmacies. - Before

you could only compare two Plans for MA and PDP plans, now you can compare

three plans - There

are new filters for selection such as star rating, company, different supplemental benefits (wellness,

vision, dental, hearing, transportation and fitness benefits), covers all the

drugs on the beneficiary’s drug list - The

plan details is much more inclusive with many of the supplemental benefits

including those that apply only to beneficiaries with chronic conditions

Medicare

beneficiaries and agents who utilize this for their clients will definitely see

a great improvement but there is still room for a better experience for

beneficiaries. Some of the immediate

ones we noticed were:

- The

ability to see if the beneficiary’s doctor is in the network – this is one CMS

is looking to tackle soon - Medicare

Supplement premiums – there is still a range of premium but CMS is hoping to

get better data to fix this issue. - With

many of the new supplemental benefits it only states whether they are covered

or not but does not show the benefit detail, such as cost-sharing and

limitations. This still does not provide beneficiaries with all the

information they need to make the best decision.

Overall it is a

great next step. Go on the site now to

get a look. Up until AEP, you see the

old site but can access the new site.

Once AEP arrives you will only be able to see the new and improved MPF.

Feasibility Studies

Two

of the most common questions plans ask are: “Where should we be offering

products?” and “What products should we be offering?” A feasibility study can

really help make that picture clearer. For plans looking to either expand or

become a health plan in 2021, this should be done as early in the process as

possible.

Some

of the top reasons to conduct a feasibility study include:

- Getting

a more complete understanding of whether service areas are financially viable, show

membership growth potential, or both - Getting

an understanding of how existing operations and performance can impact revenue

and margins and vice versa - Getting

an understanding of the sensitivity of various factors that have a large impact

on margin

When

looking at service areas, benchmarks and factors that play into the

maximization of benchmarks are very important. How are benchmark rates trending

from year to year? Does the pre-Affordable Care Act (ACA) rate limit growth? Do

pre-ACA rates limit the amount of bonus for new plans and plans that achieve

the 5% bonus? Do any areas qualify for the double bonus? Is there any upcoming

legislation that may impact payment rates?

For

membership potential, a thorough study of the markets being considered must

occur. How many health plans and products are available? What is the growth in the

number of beneficiaries joining Medicare Advantage (MA) plans? How much of the

population is aging in? What types of plans are growing membership? Do I have

existing populations through individual commercial or group pIans to whom I can

market? Can I co-brand with a provider group or hospital system?

Your

existing operations and performance can also play a large role. What kind of “lift”

will it take to build my network? Are there any risk arrangements? Will I need

a new Centers for Medicare & Medicaid Services (CMS) contract? What amount

of effort will it take with my existing systems to add a new service area or

product? How is medical management on my current population? Will my Star

Ratings positively or negatively impact the benchmarks used? If I’m not already

in MA, what kind of lift will it take, and what will it cost?

Completing

a feasibility study and conducting a sensitivity analyses can really help plans

make these decisions. For new plans, it is important to know just how sensitive

certain factors can be. These factors include provider contracting and expected

improvement in contracting rates, utilization management relative to Fee for Service

and how much improvement there will be from year to year, risk adjustment trends,

Star Ratings, administrative costs and trends, and membership. CMS expects

plans to have a positive margin by the fifth year of business. Conducting the

feasibility study and sensitivity analyses can help plans understand what has

to go right in order achieve a positive margin.

At Gorman Health Group, we have provided expertise to

government-sponsored plans in conducting feasibility studies. We have extensive

experience in the bid process as well as forecasting. Feel free to reach out

and discuss how we can assist you in developing a feasibility study for any

markets and products in which you may be interested.

CMS Seeks Comments to Proposed Audit Protocol Changes

In a Health

Plan Management System (HPMS) memo dated August 20, 2019, the Centers for

Medicare and Medicaid Services (CMS) announced they are seeking comments to

their proposed changes to the current program audit protocols, which expire in

2020. All protocol areas have updates

and clarifying language to the Audit Process and Data Request documents.

Noteworthy

changes include:

Compliance Program Effectiveness (CPE)

- Removal of the CPE Self-Assessment Questionnaire

Coverage Determinations, Appeals and Grievances (CDAG)

- Removal of the CDAG Supplemental Questionnaire

- Removal of Tables 9, 10 and 16

- Reduced the data integrity sample size to 65 (from 75)

- Increased the Grievance sample size from 10 to 20

- CMS is excluding cases that require an Appointment of Representative (AOR),

where no AOR has been received, in Tables 1-8, 14 and 15

Formulary Administration (FA)

- Removal of the ‘Website’ section of the Audit Process and Data Request

- Increased the Transition sample size from 15 to 30, clarifying claim selection

will include both protected and non-protected class drugs

Organization Determinations, Appeals and Grievances (ODAG)

- Removal of the ODAG Supplemental Questionnaire

- Removal of Table 14

- Removal of ‘Dismissals’ from the data integrity sampling to reduce the

sample size to 60 (from 65) - Removal of OD approved cases from the Clinical Decision Making section,

reducing the sample size to 35 (from 40) - Increased the Grievance sample size from 10 to 20

- CMS is excluding cases that require an AOR, where no AOR has been

received, in Tables 1-2, 4-6 and 11-12

Special Needs Plan Model of Care (SNP MOC)

- Removal of ‘Enrollment Verification’ audit element

Additionally,

CMS has removed the Medication Therapy Management (MTM) audit area from the

protocols. Impact Analysis templates for

all audit areas remain unchanged. The

updated protocols, including a crosswalk of changes, can be found here. Comments are due to CMS no later than October

15, 2019.

The

trend in reducing burden to Plans continues with these proposed changes. Gorman Health Group (GHG) suggests internal

discussions related to the proposed changes start now so Plans are best

prepared when the finalized protocols are distributed.

GHG conducts mock audits that align with the CMS Program Audit Protocols? Contact us today for more information.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

GHG Advisors is part of the Convey family of companies, which includes Convey Health Solutions, Pareto Intelligence, and HealthSmart International. Together, we collectively support healthcare organizations with elite consulting services and industry leading technology solutions. Learn more

Population Health and Care Management

The term “population health” began emerging in U.S. health care circles around March 2003 when David Kindig and Greg Stoddart co-authored an article in the American Journal of Public HealthCare Management entitled “What is Population Health?” In the article, the authors provide a working definition for population health as “the health outcomes of a group of individuals, including the distribution of such outcomes within the group.” The authors go on to stress the importance of considering the multiple determinants of health within populations that contribute to health status, such as: medical care, public health interventions, social environment (income, education, employment, social support, culture) physical environment (urban design, clean air and water), genetics, as well as individual health related behaviors.

In early 2010, CMS developed a Quality Improvement Strategy for the Medicare Advantage (MA) and Prescription Drug Plan (PDP) Programs based on the Institute of Medicine (IOM) report from 2001 and the Triple Aim. The Triple Aim concept is a quality improvement approach developed by Don Berwick, M.D., Institute for Healthcare Improvement (IHI) President Emeritus and former Administrator of the Centers for Medicare & Medicaid Services (CMS). The Triple Aim strives to drive healthcare organizations and providers to implement programs that improve the patient care experience, improve the health of patient populations, and reduce the per capita cost of health care. CMS’s Quality Improvement Strategy was expanded in 2011 to reflect the Department of Health and Human Services’ (HHS) National Strategy for Quality Improvement in Health Care, referred to as the National Quality Strategy (NQS), and the National Prevention Strategy (NPS), both of which were developed in accordance with the Affordable Care Act (ACA). CMS released the final MA and PDB Quality Strategy in June 2012. The Quality Strategy outlines, in part, CMS’ framework for promoting quality improvements in care and services for all MA beneficiaries enrolled in MA and PDP plans. The Quality Strategy emphasizes the important roles of care coordination and evidence-based protocols in improving the health of MA beneficiaries. Chisara N. Asomugha, MD, MSPH, FAAP Director, Division of Population Health Incentives and Infrastructure, with the Innovation Center at CMS has outlined CMS’s vision of population health which includes, but is not limited to, the following:

- Alignment with the CMS Quality Strategy and National

Prevention Strategy - Incorporation of population health tools and

concepts into emerging models, programs and initiatives - Development of new care management strategies

and models that incorporate social determinants of health and clinical care - Establishment of stronger linkages between

clinical care and community services

There is growing recognition in the health care community, as evidenced by the evolving strategies of quality improvement and regulatory leaders, that social and economic factors play a critical role in shaping an individual’s ability to engage in healthy behaviors. The Population Health Alliance indicates global research has revealed that the health care an individual receives predicts “only 10 – 20% of health outcomes, 20 – 30% from genetics, while 50 – 60% are based on individual health behaviors related to social and environmental factors.” Addressing social determinants of health is not only important for improving overall health of a given individual, but also for advancing the health outcomes of populations.

To achieve improvements in population health by identifying and addressing social determinants of health, industry experts, including Gorman Health Group, agree on some guiding principles to drive improved health outcomes, including:

- Assessment Tools: Understanding a person’s social needs can be challenging, especially if there are barriers to obtaining information, such as language, health literacy and even fear related to sharing deeply personal information. Currently, several state Medicaid programs require their contracted MCOs to screen for social determinants of health and then refer patients to the resources. It’s best to use an assessment tool that is short and simple, no more than twelve questions, written at a fifth grade or lower reading level, and available in multiple languages as applicable. Use of automated tools with embedded logic to identify potential referrals and resource supports are not widely in use, but are considered a best practice.

- Data Sharing and Coordination: It’s critical to utilize health management systems with capabilities to securely track, share and integrate data across multiple stakeholders; as well as manage referrals to needed resources. Technology plays a major role in fueling collaboration among individuals and their health care team and is essential to improving health outcomes and reducing health costs. On March 4, 2019, CMS published a wide-ranging proposed rule (“Proposed Rule”) with the intent to “move the health care ecosystem in the direction of interoperability” in alignment with the objectives set out in the 21st Century Cures Act and Executive Order 13813. CMS believes patients should have the “ability to move from health plan to health plan, provider to provider, and have both their clinical and administrative information travel with them throughout their journey.”

- Aligning Resources: Use of community resources is a widely accepted practice to support social and behavioral needs. Many hospitals and managed care organizations create detailed databases of community resources, including resources that are public health-funded, such as: medical and behavioral health homes, community clinics, care managers or care navigators, aging and disability resource centers, area agencies on aging, adult day health, housing authority or housing with service providers, food banks, pharmacies offering medication therapy management, as well as pharmacies that deliver medications to beside or home.

New resources/roles are appearing in primary care practices to support patient needs. Physician groups are utilizing care managers/navigators to provide critical support around care coordination and patient care management interventions. In addition to case and disease managers, managed care organizations are also employing Social Workers to support care management strategies. Social workers are trained to understand the comprehensive landscape of available social services in a community and assist patients with accessing these resources.

Lastly, many organizations including hospitals, physician group practices and managed care organizations have embraced the concept of an inter-disciplinary care team (ICT) approach to support patient needs. This involves utilizing professionals from different disciplines to work together to share expertise, knowledge, and skills; and work collaboratively with the patient. Generally speaking, the goals of the ICT are to manage care and services, to avoid fragmentation, ensure access to appropriate and person-centered care, and provide a team approach to address clinical, socioeconomic, and behavioral needs. To promote the effectiveness of the ICT, it’s important that team members understand their responsibilities and promote role interdependence while respecting the patient’s preferences and autonomy.

The U.S. chronic illness burden continues to increase, and the effect is felt much more strongly among the elderly, minority and low income populations. Opportunities abound for effective care management strategies to support and advance population health initiatives, particularly as it relates to having a positive impact on social determinants of health. Gorman Health Group has the expertise and resources to assist organizations with effective care management strategies to support population health goals.

Why Member Experience? And Why Now?

Recently, I was having a drink with a friend in the industry, and I started talking about our member experience roadmap. My friend made the mistake of asking me why I was bringing this up now – weren’t there more important things to be worrying about, such as developing the right product or Star Ratings? This upcoming Annual Election Period (AEP) is projected to be a strong one – why is member experience top of mind? Unfortunately for my friend, she had to hear a very long-winded version of why member experience is important, especially since this is a passion of mine! I'll spare you the same diatribe, and instead provide the highlights of my conversation.

Member Experience Starts with the Sales Process – Strong member onboarding during the sale kicks off the member experience process. With strong onboarding, an understanding of what to expect from the plan, and when to expect communications, the new member is likely to start off feeling confident in his or her purchasing decision. In addition, giving the member certain tasks of what he or she should do as a new member, such as making a doctor or eye doctor appointment, helps to engage them as a member.

Member Experience Affects OEP and Retention – In a recent webinar with Deft Research (Deft) and I, Deft stated the majority of all Open Enrollment Period (OEP) switchers were AEP switchers. This is a powerful reason to ensure plans have a strong member experience process in place for new members. Switching Medicare Advantage plans is a big deal. Not treating your members like it is a big deal or not providing the proper information timely and properly sets off buyer’s remorse. Before this past OEP, a plan had nearly 9 months to make a good first impression – this is no longer the case. Look at the cost of each new sale – when you lose these members during OEP, it is a real lost financial opportunity.

Member Experience Is Critical to Star Ratings – Recently, a Gorman Health Group client who went from 4 stars to a 3.5 stars asked us to figure out how much the lost half star cost them. It was over $30 million – that’s A LOT of benefit dollars! Consumer Assessment of Healthcare Providers and Systems (CAHPS®) scores help drive Star Ratings, and plans have been doing this for years. Why are plans still struggling? Because they don’t understand what is driving member frustration and fixing the root cause(s) of member dissatisfaction, and creating a positive membership experience. Developing “journey maps” and really understanding how/when to best engage your members will help areas beyond just your CAHPS®.

Member Experience Is Becoming an Important Part of Product Development – Member experience in the product development process has recently started to become a real issue – but, it is a good problem to have to solve. With the addition of multiple new mandatory supplemental benefits such as over the counter (OTC), transportation, meals, and other benefits, we are seeing growing frustration related to access to benefits. Plans today are now contracting with multiple vendors to offer these great new benefits, and the number and types of benefits are going to continue to grow. How does the member access these benefits, and what is the engagement process? Does the plan have multiple vendors sending materials to members? Are there five different phone numbers to call or websites to access? Developing the rules of member experience and a process to make it both easy and efficient for members to access benefits is really important. Plus, setting customer expectations for vendors is important in making your member experience seamless.

Strong Member Experience Programs Generate Revenue – Do the math and you will see the revenue. When you look at the lost opportunity of revenue for members switching to other plans – and the cost to enroll another member to make up the revenue – the cost of member experience programs is, in reality, a strong investment.

Enough of my rant! Back to work! But we would really appreciate the opportunity to share our passion for member experience with you. Contact us today to find out how we can help!

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

GHG Advisors is part of the Convey family of companies, which includes Convey Health Solutions, Pareto Intelligence, and HealthSmart International. Together, we collectively support healthcare organizations with elite consulting services and industry leading technology solutions. Learn more

3 Steps for Success: 2020 Material Creation and Review Season

It’s late Friday afternoon before Memorial Day weekend and the Centers for Medicare & Medicaid Services (CMS) has gifted us with the Contract Year 2020 model materials memo! Although most organizations wait until the bids are in, we are seeing some plans get a head start on their materials this week.

Last year there were multiple iterations of the model documents posted by CMS. Hopefully, the changes to documents by CMS will be minimal this year - although CMS is considering adding instructions for Medicare Advantage (MA) plans to disclose a complete list of Part B drugs that are subject to step therapy requirements in the Annual Notice of Change (ANOC) and/or Explanation of Coverage (EOC) documents. CMS is seeking feedback on this issue as well as indication-based information and mid-year changes by June 20, 2019. So we expect to see at least one round of changes to the impacted models.

Here are 3 tips to help you get ready for 2020:

- Evaluate what worked and what didn’t work well in the material review process last year. Did you conduct a lessons learned session at the end of the season? If you did not have a chance to do a lessons learned session, take some time to reflect before you start your material creation with your team. This way, you can set expectations with your team and colleagues.

- Develop tools and checklists. If these are not in place already at your organization, these resources are integral to helping in development of materials and should be developed. Having strong benefit grids, change documents of benefits from 2019 to 2020, and the listing of all current telephone numbers, websites, addresses is really important to make sure your materials are accurate.

- Taking the time to review materials is critical. These documents are painfully tedious with a high probability for error in creation. Without proper checks and balances in your review process, your probability of errors increases substantially. At GHG, we believe a two tier review process across all materials is needed for success.

Does this quick hit list warrant additional discussion within your team? If you are doing the above already, fantastic! That said, are you inundated with the day-to-day of CMS and/or Annual Election Period (AEP) planning and requests with six+ hours of meetings a day and little time to catch up and actually get your work completed? Plans today are stretched thin for the development and review of these extremely time consuming, yet critical, materials and CMS has a zero tolerance for errors.

If you need help with either material development, review or both, contact me directly at dhollie@ghgadvisors.com for more information on how we can help. But please, call quickly so we can get you scheduled.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

GHG Advisors is part of the Convey family of companies, which includes Convey Health Solutions, Pareto Intelligence, and HealthSmart International. Together, we collectively support healthcare organizations with elite consulting services and industry leading technology solutions. Learn more

Taking the Pulse of Your Population

How well do you know your members? Member segmentation, or stratification, is the foundation of your population health management strategy. Member wellness, healthcare facility utilization, and provider patient management are some of the metrics that not only meet the needs of accrediting bodies (e.g., NCQA) but also help you manage your member population efficiently, and most importantly, effectively.

Plans have tremendous amounts of data and varying levels of actionable information developed from that data. Effective stratification techniques are built on multiple data sources and types – quantitative data like lab results and claims data can identify those chronic conditions driving low quality of life and high utilization, while qualitative data derived from surveys and physician/member communication often drives discovery of behavioral health and socioeconomic issues and pre-emergent conditions that are not detected through impersonal routine testing. A combination of the two data types is the key to effective membership stratification.

The Science of Stratification: Claims-based data is most effective at generating the “big buckets” - identification of multiple chronic conditions, high utilizers of emergency facilities, little or no PCP utilization, etc. Those buckets can be further prioritized based on combinations of quantitative factors (one factor, two factors, three or more factors) and multiplied by demographic and socioeconomic issues that complicate member care.

The Art of Stratification: Combining these risk factors into something tangible. What does it mean when a member is over 65, has two chronic conditions, sees his or her PCP fairly regularly, and is not “low S.E.S.” versus a member is who over 65 but has only one chronic condition, is “low S.E.S,” and uses an emergency room as his or her PCP? This is known as the “we have data, we have reports, now what do we do to make sense of it all?” stage.

This is where population health professionals can help you to not only identify your target member populations but can also help isolate information gaps and provide effective methodologies for successful engagement with targeted members. Each plan has a unique membership, often in a unique geographic region or regions. Stratification and engagement techniques that work in New York or Connecticut will often not work in Georgia, Kentucky, or California; effective member management begins and ends with YOUR data. With population health professionals providing meaningful insights and facilitating measurable performance gains year over year, the “now what do we do” component of member management and engagement can become a non-issue, turning instead to “what can we do next.”

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

GHG Advisors is part of the Convey family of companies, which includes Convey Health Solutions, Pareto Intelligence, and HealthSmart International. Together, we collectively support healthcare organizations with elite consulting services and industry leading technology solutions. Learn more

The CMS Spring Conference Has Come and Gone!

The Centers for Medicare & Medicaid Services (CMS) held its annual spring conference, and although it was a shortened conference this year with four areas of discussion as well as a keynote address by Demetrios Kouzoukas, Principal Deputy Administrator for Medicare and Director of the Center for Medicare, they did cover some important changes about which many plans should be thinking and preparing.

Medicare Advantage (MA) Value-Based Insurance Design (VBID) Model Update

As part of its goals for the 2020 MA VBID Model, CMS is testing concepts for modernizing MA health plans. CMS did this by soliciting comments from beneficiaries, increasing the value of Reward & Incentive (R&I) programs to $600 per year, including Part D in the 2020 R&I programs, and developing telehealth intervention in rural and underserved areas.

A potential big change will be tested in calendar year 2021 when CMS plans to add the Medicare hospice benefit into the MA VBID Model. By doing so, CMS hopes to see an increase in quality and access to care while fostering partnerships between Medicare Advantage Organizations (MAOs) and hospice providers. The MAO will be the point of accountability and function as the hub to ensure access to a seamless continuum of care. Some important factors CMS is looking to address include the following:

- Respite benefits for caregivers

- Continuous level of care

- Creating opportunities for innovation

- Monitoring to ensure appropriate and high-quality care

Additionally, CMS discussed key policy considerations for 2021 VBID:

- How to ensure beneficiaries still have the ability to go to a particular hospice

- How payment will work between plans and CMS

- Evaluate and look at cost and quality

CMS will be scheduling webinars for those interested in participating, providing an opportunity to help with the design of the pilot.

New Medicare-Medicaid Integration Policies

The Bipartisan Budget Act of 2018 (BBA) requires a minimum level of Medicare-Medicaid integration for all applicable Dual-Eligible Special Needs Plans (D-SNPs). These D-SNPs must meet one of the following criteria by 2021:

- Be a Fully Integrated Dual Eligible (FIDE) SNP

- Be a Highly Integrated Dual Eligible (HIDE) SNP

- Notify the state or its designee(s) of hospital and skilled nursing facility (SNF) inpatient admissions for certain high-risk enrollees

CMS defines an “applicable integrated plan” as a FIDE/HIDE SNP with exclusively aligned enrollment and the Medicaid managed care organization through which one of the following entities covers Medicaid services for D-SNP enrollees:

- The D-SNP; or

- The D-SNP’s parent organization; or

- Another entity that is owned and controlled by the D-SNP’s parent organization.

Intermediate sanctions will be imposed during plan years 2021 through 2025 for those MAOs with a D-SNP contract not meeting one of these three integration criteria.

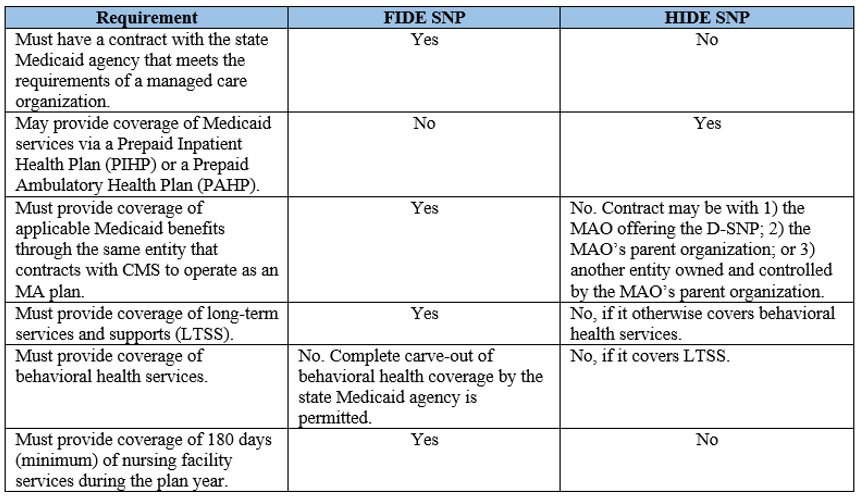

To explain the differences between FIDE and HIDE, CMS outlined the following:

The final rule establishes that all applicable integrated D-SNPs must assist members with Medicaid coverage and appeals and grievances. While appeals and grievances have been separate systems between Medicaid and MA since the beginning of time, the BBA is requiring a unified appeals and grievances procedure in 2021, including provision of continuing benefits while an appeal is pending. This, along with no deadline for filing a grievance, is likely a big change for MAOs who should start planning now for the needed changes to processes and systems.

CMS recommends starting your planning now. Work with your respective states, revise state Medicaid agency contracts, and start working out the operational and procedural changes for a unified appeals and grievances process.

If you weren’t able to attend in person or via the web, you can access the conference materials here. Also, be sure to check out the Integrated Care Resource Center at: https://www.integratedcareresourcecenter.com/.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

GHG Advisors is part of the Convey family of companies, which includes Convey Health Solutions, Pareto Intelligence, and HealthSmart International. Together, we collectively support healthcare organizations with elite consulting services and industry leading technology solutions. Learn more

Set Your Plan Apart with an OTC Benefit

Two of the buzz phrases most frequently heard in the health care community now are “value-based care” and “social determinants of health” (SDOH). Health plan leaders must leverage both to compete.

SDOH are particularly important in Medicare and dual-eligible populations, and Medicare Advantage and Part D plans are uniquely positioned to address SDOH through provider and patient incentives and value-based insurance design (VBID).

Meanwhile, federal policy has historically discouraged VBID in Medicare, but CMS is taking its foot off the brake. CMS launched a five-year VBID demonstration project in 2017, and in 2018 it further eased restrictions on MA plans that want to offer supplemental benefits in 2019. However, payers may be hesitant or unsure on how to make use of the new provisions.

How an OTC Benefit Adds Value

One way for MA plans to differentiate themselves in an increasingly competitive market and address both VBID and SDOH is by offering an over-the-counter benefit.

Without an OTC benefit, VBID may fail to realize its full cost savings potential. A recent study found that while VBID increased drug adherence and reduced spending on other services, the net savings was minimal because drug spending rose. An OTC benefit in a value-based plan could bring down those drug costs.

OTC medicines help bridge treatment gaps, are convenient and reduce unnecessary use of health care services, according to the Consumer Healthcare Products Association Clinical/Medical Committee. Millions of Americans use and trust OTC products, and health plans that don’t cover them give subscribers an incentive to choose more-expensive prescription products or to simply go without.

Plans that do offer OTC products can see a significant difference in the lives and health of their members. For example, if people with diabetes can prevent foot ulceration and, ultimately, amputation by wearing padded or compression socks, coverage of socks not only encourages their use but could prevent expensive, physically taxing wound care and surgery.

These socks are relatively inexpensive but people on fixed incomes, in particular dual-eligibles, may be unable to afford them. Coverage through an OTC benefit indirectly addresses an SDOH – income – and frees funds to pay for shelter, food and transportation.

So how can a plan add OTC coverage? With a reliable, experienced partner that offers an integrated benefit and first-class customer support.

Essentials for an OTC Benefit Partner

An effective OTC benefit partner:

- manages product selection, including purchasing and distribution

- negotiates with vendors and leverages the power of bulk purchasing for the best prices

- maintains a comprehensive call center focused on a positive member experience

- accepts eligibility files in all types and formats and processes them frequently

- generates internal audits, financial reports and CMS-required reports accurately and promptly

Added features like at-home delivery and catalog distribution both in print and online further enhance customer satisfaction and address SDOH for members residing in rural areas or lacking access to transportation. Mail service also benefits the health plan by enabling the inclusion of educational inserts in OTC product shipments.

The OTC product catalog should be tailored to the health plan’s goals and should comply with the regulatory aspects of OTC coverage. All technology used for OTC benefit administration must comply with HIPAA and the latest HITRUST security framework for robust cybersecurity and privacy protections.

A good OTC benefit partner will also be mindful of pain points for members. For example, various vendors offer prepaid cards for OTC products, but not every OTC product is eligible for coverage under CMS rules. Simply offering a prepaid card makes for frustrated customers who don’t find out until they are at the pharmacy checkout line that the supplies in their shopping cart aren’t covered.

OTC: A Bonus for Health Plans and their Members

OTC benefits offer payers a way to quickly add value, improve the SDOH and improve member satisfaction. A fully functional OTC program can be complicated, but picking the right partner who can deliver with minimal effort, full CMS compliance, and robust cybersecurity and privacy protections reduces administrative burdens while providing a significant benefit to the plan members.

Convey Health Solutions focuses on building specific technologies and services that can uniquely meet the needs of government-sponsored health plans. Convey provides member management solutions for the rapidly changing health care world. To learn more about how Convey is the right OTC benefit partner for your health plan, please visit our Miramar:OTC page.

First seen on SmartBrief.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

GHG Advisors is part of the Convey family of companies, which includes Convey Health Solutions, Pareto Intelligence, and HealthSmart International. Together, we collectively support healthcare organizations with elite consulting services and industry leading technology solutions. Learn more

You Can NO LONGER Be on Autopilot! Live or Let Die to the Nationals!

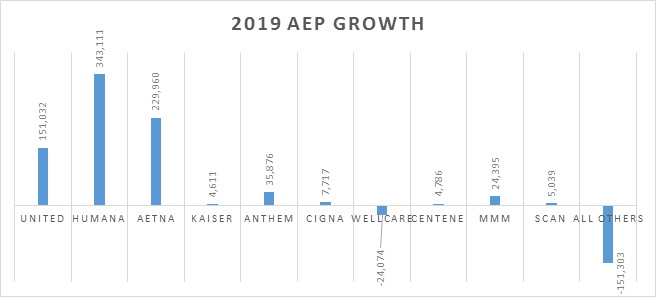

This

past Annual Election Period (AEP) was more active than in past years, and the

results show it. There were more than 600,000 net new Medicare Advantage (MA) enrollees

this AEP. The following chart shows the AEP growth of the 10 largest parent

organizations. The top three – UnitedHealthcare, Humana, and Aetna – had

significant gains in enrollment – more than the total growth nationwide. Humana

and Aetna killed it this AEP with a combination of super competitive plans and

expansions into new counties.

What is really concerning is the “All Others” line that had a combination of more than 150,000 members and a 3% loss! Are you one of those “All Other” plans? Last year was the perfect year to “go big” with your benefits, marketing, and aggressive sales distribution strategy to compete against the nationals. We saw and helped a few “All Other” plans do it well and win in the market.

But

don’t worry – if you missed out last year, this year will be another

opportunity to grow your market for 2020. You need to take a long hard look at

what you’re doing and why you’re doing it. And it takes a strong mix of the following:

- Product

- Marketing

- Sales

Distribution

Product

But

you can’t do it by changing a couple of benefits or adding another direct

mailing or field marketing organization (FMO) to the mix. You’ll want to do a

thorough assessment of your product, marketing, and sales strategy to ensure

you are keeping abreast of both local and national trends in the market and

really take a good hard look at what you need to change for 2020. Don’t wait to see what the market will do next

year – lead the market this year!

From

a benefit and product perspective, the Centers for Medicare & Medicaid

Services (CMS) has given plans the ability to be really creative and create

some benefit differentials. In addition, the new benefit opportunities are

screaming at plans to truly understand their members and put benefits in place

to make an impact on their members’ health and your medical loss ratio.

Have

you done a deep Medicare Plan Finder (MPF) dive to understand where and why you

are on Page 1 – or Page 10? Did you ever wonder why one of your competitors

whose benefits are not as strong as yours has a better position on MPF? There

is a science to MPF, and you need to understand how to arrange your benefits to

be best represented in the market.

Marketing

From

a marketing standpoint, how do you stand out from the crowd – is it in a good

way? The nationals have bigger budgets, so you need to maximize your spend

wisely. There are three things to consider:

- Creative: Pretty creative doesn’t always

sell – make sure your ad agency is not setting themselves up to win awards. Are

you getting out there with marketing that generates leads? It’s the marketer’s

responsibility to make sure the benefits that prospects want in the market are

being highlighted multiple times throughout the creative. - Models and Targets: GHG has seen MA plans

utilize models that are really worthwhile, while others utilize the same model

to death and forgetting that when you make changes to your products and

benefits, you can change the dynamics of your targeted segments. - Have you really micro-managed your

marketing channel analytics to understand what channels need to be further enhanced

or have decreased spending? In this day of omni-channel marketing, it’s getting

harder to really understand the dynamics of your marketing dollar, and that’s

why it’s more important to understand how each channel is operating on its own

and in concert with other channels. Are you testing new opportunities? Are you

testing at all?

Sales Distribution

Strategy

Sometimes

you really need to take a fresh look at your sales distribution strategy:

- Are

your FMOs providing the value you need? Should you be utilizing FMOs? In

competing against the national carriers, who rely heavily on FMOs, how do you

stand out in the crowd? - Are

your employed representatives trained properly? We have seen many sales teams

that have received little to no sales training. Having a strong sales team,

whether they are on the phone or out in the field, is critical in today’s

world. - Understand

that your vendors can be the difference between making goals or not making

goals. In today’s environment, many MA plans outsource critical functions,

especially when it comes to the call center. How are you overseeing reporting

and quality? What is the turnover rate, and how involved are you in training?

Sometimes

we need to step back and really take a fresh look at how and why we are running

our products, marketing, and sales? We need to take a look at how others in the

industry are conducting business, especially those that are gaining membership.

This doesn’t mean we need to copy them – but what should we be doing better

and/or differently to get an edge in the market? This is an exercise that

should be done every year to stay in the game.

If you need help with assessing what you could do differently in your product, marketing, and sales distribution strategies, give me a call – I would be happy to talk with you.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here