Taking Advantage of Reimbursement Increases & New Benefit Opportunities for MA?

The Centers for Medicare & Medicaid Services (CMS) has provided increases in reimbursement to plans, and Gorman Health Group believes this trend will continue for Medicare Advantage (MA) for the immediate future. So how are you taking advantage of this?

- Are you increasing your service area?

- Are you entering MA for the first time?

- Are you increasing your benefits and lowering premiums in existing plans?

- Are you introducing new products that will be more competitive in the market?

If you answered “yes” to any of these questions, the time to start planning for 2020 is now.

The Notice of Intent is due to CMS on November 12 of this year. You now have less than two months to ensure you have a clear strategy in place if you plan on increasing your service area or are entering MA for the first time. If you answered “yes” to either question #1 or #2, now is the time to do the following:

- Market analysis of proposed new counties you are planning to enter

- Three-year enrollment opportunity analysis

- Development of a scorecard to understand which counties have the best opportunity

- Feasibility study to provide guidance on how long it will take to be profitable

For existing plans that are not expanding their service area, now is the time to do the following:

- Membership analysis by plan including:

o Age

o Geography

o Length of time with plan

o Chronic conditions and how they affect the MLR

o Disenrollment findings

o Plus other data based on the story it tells - Competitive product and benefit analysis utilizing 2019 plans and benefits

- Market analysis

Now is the time to develop your strategy so by 1st quarter 2019 you are ready to start implementing your strategy for new plans and more competitive benefits for 2020. CMS have now given plans enormous leeway in developing benefits—now is the time to take advantage of this opportunity. Today, some benefits will need to have returns on investment, and others will need to be researched to find new vendors to actually provide the benefits. In addition, you need to ensure operational limitations are not hindering you from finding the right set of benefits for your plans.

If you need help, please don’t hesitate to contact me. We at Gorman Health Group are happy to assist in any way.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Network Development in the Era of Relaxed Supplemental Benefit Regulations

As we saw in this year’s Centers for Medicare & Medicaid Services (CMS) regulations, Medicare Advantage (MA) plans are gaining greater flexibility to design and offer new types of benefits to service their members. While the information was provided after many plans had already put significant time into their Contract Year (CY) 2019 bids, we anticipate in CY 2020 to see MA plans branching out and offering more variation and specialized benefits geared towards their population.

When MA plans begin to formulate their sales and marketing strategy and determine the impact a variety of benefits could have based on addressing the particular social determinates of health that most impact their geographic area and member population, we begin to see a vast gap in the playing field from plans staying close to the basics with meals and non-emergent transport to plans willing to take more risk, having unexpected cost and the willingness to invest in innovative benefit options without knowing the exact return on investment the benefit will have on patient outcomes or financial upside/downside cost. We may see an upswing in partnerships with transitional assisted living to skilled nursing facilities, vendors offering adaptive aids to keep patients in their homes longer, meal or grocery delivery services, as well as an expansion on transportation services.

From a Provider Network perspective, the move forward with new partnerships will likely present a few stumbling blocks along the way and offer a ramp-up period we do not see with traditional MA providers. We encourage you to start early and break down the silos by having group discussions to include Sales & Marketing, Medical Management, Star Ratings, Operations, and Provider Network. The new providers are likely going to be dipping their toes in the same deep end of the pool, and extra lead time and planning will serve you well.

We would encourage all MA plans to have:

- Planned education sessions/town hall meetings to educate and get to know the new vendors/providers and hear what their needs are

- Plan for a more lengthy contracting process

- Plan for additional onboarding and training with the new vendors

- Allow for additional member education time

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

The CMS Fall Conference Highlights

The Centers for Medicare & Medicaid Services (CMS) annual fall conference never misses in providing important information for Sponsors. This year’s conference was held in Baltimore on September 6, 2018. Conference materials can be found on the Compliance Training, Education & Outreach website here. CMS covered many areas, but here I’m focusing on two key areas of the conference: Medicare Communications and Marketing Guidelines (MCMG) updates and appeals and grievances classification best practices.

MCMG

One of the most important clarifying statements from CMS was definitively communicating the MCMG replaces the Medicare Marketing Guidelines (MMG) and any guidance within it. What does that mean? If previous MMG guidance is not dictated in the MCMG, Sponsors should consider that guidance obsolete. While many had assumed that was the case, it’s always better to get clarity straight from the source. This single statement should resolve many looming questions by Sponsors.

Of equal significance was CMS further outlining the meaning of “marketing” material. In order to be considered “marketing,” the material must meet both intent and content requirements. If only one of these distinctions is met, the material would not be considered “marketing.” The example used to help drive this message was the Evidence of Coverage (EOC). The EOC has content that would meet “marketing” definitions, however, the intent is not to persuade a beneficiary to enroll, so it is considered a communication. This new guidance will eliminate much burden for Sponsors in relation to the number of materials requiring CMS review and submission. While this removes some administrative burden, the oversight may need to be more stringent as health plans are now even more responsible for correct classification of documents and ensuring documents still comply with all CMS requirements. Additionally, documents must be available upon request.

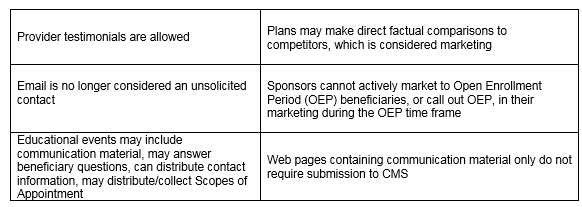

Other noteworthy clarifications from CMS:

An updated MCMG was distributed by CMS on September 6, 2018.

APPEALS & GRIEVANCES

In their continued effort to help Sponsors in the appeal and grievance space, CMS and Sponsor representatives presented classification best practices. CMS reminded Sponsors of key words when classifying appeals and grievances:

Inquiry ----- a question

Grievances ----- a dissatisfaction

Coverage/Organization Determination ----- a decision to provide or pay

Appeal ----- a dispute of a previous decision

Several health plan speakers shared their best practices. Some of the valuable recommendations that changed their organization included:

- Centralized Customer Service staff focused on identifying appeals and grievances. Staff training focused on real-life examples and involved frequent refreshers.

- Cross-functional all staff on grievances, coverage and organization determinations, and appeals. Training not only included correct identification and classification but also the downstream member and CMS impact of failure to correctly identify complaints. This holistic approach supports the member experience and greater CMS compliance.

- Intake staff who review cases quickly to identify any potential misclassification of cases. Root cause analysis as a routine part of processing. So often the focus is on resolving the identified issue for that member, which is critical. Equal importance is remedying any systemic concerns to prevent the problem from impacting other members. The presenters discussed how root cause was discussed in routine meetings with other departments for brainstorming and resolution.

- Embedded Compliance staff within the business units. A great trend in the industry in recent years is to have an operational Compliance person located in critical operations units. They are available to help staff work through complex issues where a keen eye on regulatory guidance is needed. This keeps cases moving forward and allows staff to feel supported all while maintaining high compliance.

CMS conferences have always been valuable resources in clarifying new changes or functions that have the attention of CMS. Don’t miss utilizing this valuable resource to stay current.

Gorman Health Group provides training tools, conducts mock audits, and supports process improvement initiatives related to Parts C & D appeals and grievances? We also provide interim staff for clients when they have a need in this area.

Gorman Health Group provides training tools, conducts mock audits, and supports process improvement initiatives related to Parts C & D appeals and grievances? We also provide interim staff for clients when they have a need in this area.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Barriers to the New Opioid Care Coordination Safety Edit for 2019

The Contract Year (CY) 2019 Call Letter and Centers for Medicare & Medicaid Services (CMS) expectations for all sponsors to implement a real-time opioid care coordination safety edit at the time of dispensing as a proactive step to engage both patients and prescribers about overdose risk and prevention will require:

- Implementing a point of sale (POS) safety edit days’ supply limit of 7 days for initial fills of opioids (for opioid naïve patients).

- Implementing an opioid care coordination soft POS safety edit at 90 Morphine Milligram Equivalent (MME) per day.

- In implementing this edit, sponsors should instruct the pharmacist to consult with the prescriber, document the discussion, and if the prescriber confirms intent, use an override code that specifically states the prescriber has been consulted.

- Sponsors will have the flexibility to include a prescriber and/or pharmacy count in the opioid care coordination edit.

- Sponsors will also have the flexibility to implement hard safety edits and set the threshold at 200 MME or more and may include prescriber/pharmacy counts.

These new requirements have created an urgency for the National Council for Prescription Drug Programs (NCPDP) to evaluate guidance that could possibly require new reject codes and override codes for POS safety edits. The NCPDP Telecommunication Standard is the standard used for eligibility, claims processing, reporting, and other functions in the pharmacy services industry as named in the Health Insurance Portability and Accountability Act (HIPAA) and in electronic prescribing as named in the Medicare Modernization Act (MMA). With the expectation the opioid care coordination edit should be implemented in 2019, there is very little time for the industry to develop and implement a standardized communication process for these safety edits where there are variations in the exception criteria.

The opioid care coordination edit will allow pharmacists to play a greater role in patient care, but this will require the development of standardized electronic edits and documentation to facilitate POS rejects that currently require a coverage determination initiated by the prescriber. In addition, the intent of the POS soft safety edits to bypass the coverage determination process for clinical safety edits could create audit risks for the pharmacy without the additional POS codes to override soft edits in opioid care coordination. An added burden, given the implementation time frame, is the CMS expectation that sponsors’ network pharmacies and customer service representatives be adequately trained with regard to these new care coordination edits. NCPDP hopes to work with CMS in identifying effective, less burdensome approaches using industry adopted standards that will yield safer and appropriate opioid prescribing and ensure patient access to care and alleviate any confusion on the intent of the soft and hard POS edits proposed in the CY 2019 Call Letter.

On one hand, the national opioid crisis is urgent, and relying on technology to contain the crisis is essential, however, the NCPDP Telecommunication and SCRIPT standards do not currently support the edits and the necessary documentation that needs to be captured between the prescriber and the pharmacist. There will be a need to standardize this across the industry for opioid MME claim rejection and override codes. In the meantime, stakeholders would need to rely on manual attestation and documentation processes. Plan sponsors will have to review their current opioid policy to ensure a variety of tools are in place to address all the issues and to ensure their pharmacy benefit managers (PBMs) and call centers are ready in 2019.

Gorman Health Group can help in developing effective, proactive utilization management programs for Part D opioid utilization. Our experts are available to assist in the design of a comprehensive opioid overutilization prevention program that can address member, provider, and pharmacy care coordination policy per CMS guidance and expectations.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

How to Avoid Network Development & Expansion Pitfalls

Network management, directory accuracy, service area expansions (SAEs), and the new triennial review process have placed many Medicare Advantage (MA) plans in flux and exposed serious issues – from policy to process to staffing and technology. As we move into the countdown for network development and expansion for 2020, a review of lessons learned will be helpful in planning and avoiding some of the pitfalls from 2019.

- In previous years, plans submitted their Health Service Delivery (HSD) tables with their applications, and, by the end of April, there was clear insight into which counties the Centers for Medicare & Medicaid Services (CMS) deemed to have an adequate network. This year provided a new challenge with bids being submitted prior to HSD tables being uploaded and reviewed by CMS.

As multiple new regulations on network adequacy and directory accuracy have been implemented, a lesson learned by many is there can never be too much communication and oversight in managing provider network contracting and credentialing data.

- Overall project management and poor communication between outside vendors during an expansion can lead to stressful situations and put the plan at risk for compliance actions. Planning ahead and including oversight and transition plans at the start of any project can lessen the risks down the road.

Here at Gorman Health Group, we have been brought in and have identified situations described and have outlined extensive work plans to include policy and procedure (P&P) changes, technology updates, network development plans, compliance solutions, and assisted plans in working through the corrective action needed.

We can’t stress enough how the cost of prevention and planning on the front end becomes even more cost effective when faced with correcting on the back end.

Summer is the best time to be proactive and start planning your next SAE or even your first step into the MA world. Alternatively, perhaps, summer offers just the right amount of downtime to start planning for updated oversight policies.

As you start your initial or expansion planning process and set new network monitoring processes in place to ensure preparedness, consider this: Gorman Health Group has a long history of providing the following:

- Leveraging long-standing relationships and nationwide experience coupled with a cost-effective team of Senior Consultants and Network Analysts to effectively stand up a contracted provider network

- Designing and developing a network strategy and product strategy that take into account the quality, financial, risk adjustment, and Star Ratings goals for success within the competitive landscape of your market(s)

- Developing the oversight and monitoring P&Ps needed to address the new network and directory requirements

- Preparing plans’ HSD tables for a CMS filing or bid submission as well as preparing network exceptions to include all the required elements.

Let us know how we can work together now to support your plan’s goals for the future. We’ve been there, fixed that, and will ensure your success. Contact me directly at emartin@ghgadvisors.com.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

CMS Takes Action to Lower Drug Prices, Permits Step Therapy

I have been known to utter “holy cow” in my day, and the recent Centers for Medicare & Medicaid Services (CMS) Health Plan Management System (HPMS) memo allowing step therapy for Part B drugs was the reason for my most recent exclamation. Who saw this coming?

The first sentence of the memo reads, “CMS is hereby rescinding our September 17, 2012, HPMS memo, “Prohibition on Imposing Mandatory Step Therapy for Access to Part B Drugs and Services.” Holy cow. For some time, the Part B versus Part D issue has been the bane of Medicare Advantage (MA) plans. CMS has tried over the years to ease that pain by issuing guidance on when a drug can be billed as Part B and when it should be billed as Part D. As late as the 2017 Call Letter, CMS reminded us of the new 2016 requirements at 42 CFR §422.112(b)(7), which require all plans to establish and maintain “a process to ensure timely and accurate POS transactions, and to issue a decision and authorize or provide the benefit as appropriate under Part B or Part D when a party requests a coverage determination.” So why the about-face on requiring expediency in dispensing Part B drugs? It all comes down to cost containment.

Step therapy has been a mainstay in Part D drug utilization management to help contain the cost of medications. The idea is for the beneficiary to use an effective and less expensive drug before moving onto more costly therapies. This makes good sense. Why pull out a flame-thrower when a match will work? Historically, Part B drugs have not been subject to step therapy – providers either pulled their preferred drug from the shelf or wrote a prescription the pharmacy filled under Part B. Now Part B drugs will be subject to the same coverage determinations and appeals processes for step therapies Part D drugs have enjoyed. How might this affect what providers stock in their offices? And how about Home I.V. and Long-Term Care pharmacies? These pharmacies have had the luxury of dictating what products would be used in the past, and Part B step therapy will be a game changer as plan sponsors take back control over what is dispensed. Holy cow.

While cost containment is desired, there are also unintended consequences. Beneficiaries may experience a delay in obtaining their drugs due to determinations and appeals processes. Part D drugs are subject to coverage determinations that have a 72-hour time frame for standard determinations and 24 hours for expedited determinations. Part B drugs are subject to organization determinations. These Part B pre-service determinations have a 14-day time frame for standard requests and a 72-hour time frame for expedited requests. In last night’s memo, CMS “strongly encourages that MA plans expedite requests for exceptions in Part B to align with the 72-hour adjudication timeframe for requests in Part D.” Holy cow. Plan sponsors will need to implement a procedure for their organization determinations, appeals, and grievances staff so drugs can be given priority over other requests.

Plan sponsors will also have new Part B issues to deal with. The memo calls out the need for “interactive medication review to discuss all current medications,” which may be code for Medication Therapy Management (MTM). How will these new requirements affect MTM programs and targeting of eligible beneficiaries? Chapter 7, Section 30.2 (2) and (3), of the Medicare Prescription Drug Benefit Manual speaks to targeting Part D drugs only for both numbers of drugs being taken and dollar amount thresholds. Is the expectation that Part B drugs be added to these targeting thresholds?

And last but not least is the job of actually developing Part B step therapy criteria. Local Coverage Determinations (LCDs) and National Coverage Determinations (NCDs) will still apply, and we know beneficiaries already using a Part B drug will be grandfathered in. CMS is allowing “cross-contamination” of steps. Plan sponsors may require a beneficiary to use a Part D drug before getting a Part B drug and vice versa, requiring a Part B drug before receiving a Part D drug. Can step therapies incorporate both Part B and Part D drugs within a specific step? And who will review exception requests – the organization determination team or the coverage determination team – when both Part B and Part D drugs are incorporated into step therapies? Thinking about the possibilities is absolutely mind-numbing.

And, of course, the window for uploading these new step therapies is fast upon us – August 17 through August 21. Holy cow. So get those Pharmacy & Therapeutics Committees cracking! And while you’re at it, you may want to check with your Marketing Department to see how far along you are in the development of your Annual Notice of Change and Evidence of Coverage. If you can’t hold the presses to add these new step therapies, you will need extra time to develop addendums to be sent to your beneficiaries.

I am looking forward to seeing how this new twist to an already complex benefit will play out in 2019. As always, if you need help navigating the rules, regulations, and best practices, Gorman Health Group has the experts to help you.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Top 10 Changes – NEW Medicare Communications and Marketing Guidelines (MCMG)

Gorman Health Group will conduct a webinar on the new guidelines in the next couple of weeks, but we wanted to get this out right away as the Centers for Medicare & Medicaid Services (CMS) has rewritten the Medicare Marketing Guidelines (MMG) for 2019. A lot of information is the same but just condensed – there are a lot changes! Here is the top 10 list of 2019 CMS MCMG changes:

- CMS has grouped activities and materials into Communications and Marketing that are distinguished based on intent and content. It will be important to understand the differences and educate your staff since interactions with beneficiaries can start out as a communication and end up as a marketing communication – with different compliance requirements.

- Plans/Sponsors may compare their plan to another plan/sponsor provided they can support the comparison through studies or statistical data and the comparisons are factually based. CMS does not provide any detail on the scope of studies or time periods required for statistical data, so proceed with caution if considering publishing plan comparisons.

- Plans cannot market during the Open Enrollment Period (OEP) or engage or promote agent/broker activities to target the OEP as an additional marketing opportunity but can do the following:

- Market to beneficiaries who are new to Medicare, also known as “age-ins,” who have not yet made an enrollment decision

- 5-star plans can continue the Special Enrollment Period (SEP)

- Market to dual-eligible and low-income subsidy (LIS) beneficiaries

- Send marketing materials and have meetings with those who request the information/meeting, and provide OEP information via the call center

- CMS has provided detailed guidance on activities in the healthcare setting with an emphasis on differentiating between activities a provider (or pharmacist!) performs as a matter of a course of treatment versus activities a plan or provider performs aimed at influencing an enrollment decision. If you recall, this was one of the specific topics for consideration for which the agency sought feedback in its April 12, 2018, request for input on this guidance.

- There is a new Material ID process – plans must use a “C” for communication materials or “M” for marketing materials at the end of the Material ID. Here is an example: H1234_abc567_C.

- Documents such as the Summary of Benefits (SB), Evidence of Coverage (EOC), Annual Notice of Changes (ANOC), directories, and formularies need to be posted by October 15. CMS has listed each required document in a chart that describes to whom required, timing, method of delivery, Health Plan Management System (HPMS) timing, format, additional guidance, and translation requirements. This is very helpful.

- Plans no longer have to mail the EOC to existing enrollees, but the ANOC must be mailed. If a new member enrolling throughout the year (for example, for a June 1 effective date) requests hard copy materials to be mailed to him/her, the hard copy request must be fulfilled within three business days, and the request remains in effect until the member leaves the plan or requests that hard copies be stopped.

- Plans must keep their call centers open 7 days a week, from 8 a.m. to 8 p.m., for an additional 6 weeks – from February 14 to March 31. These additional costs need to be factored into next year’s budget, and sponsors should be having conversations with any call center vendors supporting this line of business.

- The rules for disclaimers have changed again, but now it’s easier! Make sure you read each disclaimer since parts of some disclaimers are still needed or if you mention 10 or more benefits.

- Plans must submit website marketing content for review, including contracted third-party websites. Plans do not need to submit web pages with or containing CMS-required content for review. This is a 45-day review! This means almost every website needs to be reviewed now. Website content that has not been reviewed/approved cannot be viewable to the public. This is a significant change as sponsors were previously permitted to post websites that were pending review.

This is not a year to skim through the guidelines—we are still reading and re-reading the document to make sure we understand the implications. Good luck, and watch for our webinar in the upcoming weeks!

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Focus on Rural Population: What Your Plan Still Has Time to Do

Here we are at the end of July already! Time flies, especially when we are busy preparing for enacting our bid submission approvals and planning for rollout of plan year 2019 activities and new members. It is not too late to still enhance this year’s activities and positively affect our members within the remaining five months of this plan year, especially in the rural areas of your plan’s service area. CMS released its first "rural health strategy" here: https://www.cms.gov/Newsroom/MediaReleaseDatabase/Press-releases/2018-Press-releases-items/2018-05-08.html

Barriers to care/access and disparities for the rural service areas and their communities are routinely missed as a focus for a care management program objective, a quality improvement process, or independent study within population health management.

Here are a couple of tips to consider and questions to ask yourself as a plan that can truly be implemented within this plan year:

What do you know (or not know) about your rural populations specifically?

Age bands overlaid by claims data/GeoAccess: Oftentimes, populations in rural areas are older than those residing in urban areas. This means access or capability to access care is a potential issue right off the bat. Elderly populations who may be isolated by a rural geographic location due to distance to care can be compounded by other issues: daylight hours available to drive, their own vision, condition of their vehicle, if they have to care for others…you get the picture. Do we as an industry really take into account how to identify those who are isolated by being rural? I believe we can do better!

Plans could take their specific rural counties and break down by age bands the populations who live there; overlay the claims utilization to determine patterns of care AND potential barriers. For example, if you have vision as a supplemental benefit, and you know your elderly population in the rural service area cannot access the vision stores due to the fact they are all urban, how do you expect these members to access care SAFELY simply by having the vision benefit? What can you consider to support these folks? This is where telemedicine could become your new best friend to support the reach your network cannot. I believe plans could use the telemedicine option more than we see today. Many plans are not aware of the details, the codes, and what the benefits are, so please educate your network teams, provider networks, and update your care management program to include this option. If you are not sure what the rules are, look here: https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNProducts/downloads/TelehealthSrvcsfctsht.pdf.

Also, consider engaging a home visit vendor to support this population – you will want to make certain that networks can deliver in the rural areas and not face access to members’ issues.

If your plan does have rural hospitals that service your rural counties, please be certain to mine this facility’s utilization, emergency room, observation, and inpatient data. Frequently, rural hospitals serve communities with greater rates of diabetes and known associated hypertension and obesity, all of which speak to the rural community structure and lack of urban services.

Don’t forget the analysis of rural service area prescription drug claims. Drug claims alone often identify issues for and about plan members that may not otherwise be exposed.

Introduce “rural service area access” into your quality program as a quality improvement project. Because rural communities face provider shortages, especially primary care, as well as behavioral health, dental, and vision, consider enacting a rural clinical day, either through a Federally Qualified Health Center (FQHC) or other partner to draw members to a one-stop shop day of service. Sort of like a spa day but for health! If folks cannot get there, offer transportation, too!

Thinking outside the box to enhance our rural populations’ access, engagement, and health outcomes could only benefit everyone. If you need assistance to evaluate your plan’s populations, creative care model changes, please reach out to me at jscott@ghgadvisors.com.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Trump Administration Alarms PBMS with First Drug Pricing Initiative

The Department of Health and Human Services (HHS) issued its blueprint for dealing with the high price of prescription drugs in May, and the administration is finally undertaking a number of initiatives to operationalize the proposals. So far, as seen from the updates below, the proposals will have the biggest impact on pharmacy benefit managers (PBMs) and payers.

Voluntary Price Drops

Several weeks ago, President Trump tweeted that Pfizer was not following the intent of the blueprint and actually met with the Pfizer CEO at the White House to put pressure on the drug company to delay price increases. As a result, Pfizer will delay price increases on 40 drugs from July until early in 2019. Last month, Novartis postponed a price increase for its autoimmune drug Cosentyx in response to California’s new drug transparency pricing program. The Novartis CEO also announced this week the company would not have further price hikes this year after it raised prices for three costly cancer therapies a few weeks ago. Another major manufacturer, Merck, announced a 60 percent drop in the price of its hepatitis C treatment Zepatier and will make 10 percent pricing cuts to some other products. News sources report, however, HHS Secretary Azar is not counting on these voluntary actions, “We're driving swift, firm regulatory action and legislative action that's going to create every incentive to bring prices down in this country." A deeper investigation by reporters also found these price decreases were mostly illusory, however, they do show drug companies are working with the administration and likely have no reason to fear future HHS proposals. This brings us to HHS’ first significant proposed rule, currently under review at Office of Management and Budget (OMB).

The End of Rebates As We Know It?

The Office of Inspector General sent a proposed rule to OMB to change the current safe harbor protection for manufacturer rebates paid to insurers and PBMs and establish a new safe harbor rule. Naturally, the proposed rule indicates it would have a substantial impact on the industry of over $100 million. While we don’t have details on the proposed rule at this time, Azar previously testified to Congress he was considering prohibiting rebates to PBMs because, in his view, PBMs whose role is to negotiate discounts can actually benefit from higher list prices. The Pharmaceutical Care Management Association which represents PBMs noted two studies, one from the OIG that found reducing or eliminating the safe harbor for rebates and other discounts would not reduce drug prices. The Pharmaceutical Care Management Association (PCMA) also challenged HHS’ authority to change the safe harbor requirements without congressional action. Depending on the severity of the new rule, a change in drug rebates could have immense implications for PBMs and insurers. It is also unclear which programs the new rule would impact. As Thomas Johnson, Gorman Health Group’s Medicaid expert, noted, “For Medicaid, the drug rebate has been crucial in encouraging states to use Medicaid managed care.”

Drug Importation?

In a third effort to reduce drug costs, the Food and Drug Administration (FDA) announced it will create a working group to explore drug imports to curb drug prices. The FDA will initially focus on imports of drugs when there is a sharp price increase in the U.S. for an off-patent drug produced by a single manufacturer. The Washington Post noted responses from stakeholders that such a limited response would not address the overall trend of increasing drug prices for brand name drugs.

The blueprint talked about increasing competitive pressures for drug prices to come down and the actions this week between the administration and the pharmacy manufacturers and PBMs suggest jaw-boning at least before the election may have an impact even if only temporary and symbolic. However, it should be noted proposed regulations like changing the safe harbor for rebates take months to get to a final rule and the voluntary price reductions are also only temporary – until the end of the year and after the election. The FDA working group will also take time to agree on a strategy to curb imports of drugs that have not been previously approved by the FDA.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Prep for the 2019 Medicare Communications and Marketing Guidelines

I am shocked the 2019 Medicare Marketing Guidelines (MMG) did not come out last Friday since that is when I started vacation. But no… a week later, we are still waiting, and now the wait really starts to impact the development of our marketing strategies and tactics.

In reviewing the April 12, 2018, Centers for Medicare & Medicaid Services (CMS) memo asking for request for input on the 2019 Medicare Communications and Marketing Guidelines, our Marketing team at GHG got together to think about what we would do right now not knowing what the changes are and not being 100% sure if these changes are going into effect. Here are a few suggestions to get your marketing team ready for what we are expecting:

#1 Disclaimers: There is a good chance many of the current disclaimers will be modified and/or deleted. This should not stop you from developing creative materials, although you should have some alternative copy ready to be utilized if the majority of disclaimers go away. Some ideas to consider:

- Laundry list of most important benefits

- Additional “call to action” copy to get prospects to either call you or go to your website

- Copy that clearly states your differential in the market – and it doesn’t matter if this is a repeat of copy. Repeating the most important points you want a prospect to remember is an important strategy!

#2 Font Size: If CMS no longer mandates that all marketing materials have at least a Times New Roman 12-point font type, it will be much easier for the Marketing teams to fit in additional copy points. You may want to develop materials in 11-point and 12-point font to see what extra space you may gain. You may be able to utilize some of the ideas above to help increase marketing points, especially on postcards. Although remember – those whose eyes are over age 65 are not able to read very small type, and if you reverse out the type, it may become illegible, so we would not recommend anything smaller than 11 point font.

#3 Referrals: If CMS allows you to announce that you can offer a gift for a referral and you can request email addresses when asking for referrals in addition to the mailing address – start planning for a mailing now! What free gift could you provide for a referral? Think about allowing members to send referrals to the plan by email, phone, as well as mail so you can utilize these leads quickly for the Annual Election Period (AEP).

#4 Business Reply Cards (BRCs): BRCs that do not mention plan-specific benefits do not need to be submitted into the Health Plan Management System (HPMS). Make sure now that your BRCs do not mention benefits. This is an easy fix—make it now.

#5 Provider Communications: CMS is expected to clarify it is not a violation of CMS marketing requirements if contracted providers notify their patients that the contract status between the provider and the plan/Part D sponsor is changing. We have seen many plans this year developing benefits and products with their providers. Utilizing providers to communicate this relationship during AEP is important. You don’t have to wait for the guidelines to be released on this one – it is already allowed!

Resources:

Benefits are Submitted. What’s Top of Mind for 2019 Marketing and Sales? Learn more

Whether you need help establishing an effective member experience or member communication strategy, cataloging and evaluating existing member communications, or identifying opportunities to streamline and strengthen your member engagement tactics or interventions, we can help. Read more here

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe