Top 10 Changes - Draft Medicare Communications and Marketing Guidelines

Centers

for Medicare & Medicaid Services (CMS) has released the draft Medicare

Communications and Marketing Guidelines (MCMG) for 2020. Of the CMS draft MCMG

changes, here’s our top 10:

- Plans must include a toll-free TTY number when a telesales number is listed in the same font size as the other phone numbers. This requirement no longer applies to the customer service number only. Plans must ensure that all materials include this update moving forward.

- Plans/Part D sponsors are now required to submit via the Health Plan Management System (HPMS) hold time messages that include benefit information or promote the plan.

- The Centers for Medicare & Medicaid Services (CMS) clarifies that plans must submit their website annually, must include a material ID for the current year on all web pages, and subsequent website submissions with updated marketing content must include a note on where to find those changes on the website along with the summary of changes.

- Administrative payments to field marketing organizations (FMOs) can continue to be based on enrollment, provided payments are at or below fair market value (FMV). When impracticable, administrative payments made to agents/brokers, such as mileage and materials, may also be based on enrollment. However, CMS expects organizations to pay actual expenses when possible. Payment structures must be determined prior to a plan year and remain in effect throughout that plan year. Plans must make payment structures available to CMS upon request.

- Document changes:

- Annual Notice of Change (ANOC), Evidence of Coverage (EOC), and formulary erratas may be provided electronically if the enrollee has opted in to receiving electronic versions.

- If an enrollee has requested a hard copy directory, the plan may attach an addendum of recent updates instead of printing an entirely new document if the request is made prior to the annual update. CMS does not expect a hard copy directory or addendum to be sent whenever there is a change to the directory.

- Plans must not indicate effective or term dates in the provider directory if a provider is listed prior to the effective date or is confirmed to leave the network.

- CMS clarifies that sales lines at organizations are not required to follow the customer service call center hours of operations requirements.

- The “health and wellness information” mailing statement has been removed from guidance.

- The plan Online Enrollment Center Disclaimer “Medicare beneficiaries may also enroll in <plan name> through the CMS Medicare Online Enrollment Center located at http://www.medicare.gov” has been removed for 2020.

- The disclaimer “This information is not a complete description of benefits. Call [insert customer service phone number/TTY] for more information” has been removed for 2020.

- The federal contracting statement is no longer required on communications that are not marketing. The federal contracting statement is only required on marketing materials.

There are several other changes being suggested – this is just our top ten list. Plus, all draft changes continue to be subject to further change until the final MCMG are released.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

Better Billing, Better Consumer Experience

The Medicare

Advantage market is heating up – a trend that’s expected to continue, according

to a new Kaiser Family Foundation report. In 2019, there will be 417 more MA plans than

this year. Fourteen new carriers will offer plans in 26 states, with only five

carriers exiting the market.

As market

competition in MA becomes fiercer, it is increasingly important for payers to

stand out with a better consumer experience. One way to do that is with an

integrated billing platform that can streamline the process for both payer and

consumer.

Pain Points for Payers

Health plans face

a variety of pain points with their MA billing platforms, and they are still

struggling to get it right. Many platforms were designed for other markets with

substantially different customers and compliance concerns, and retrofitted to

Medicare. Instead of being integrated systems that take applicable rules and

regulations into account, they are disjointed and make for an error-prone

consumer experience. The result can be unhappy customers, frustrated customer

service representatives and lost business.

One significant

challenge for payers is tracking members’ eligibility and subsidies. A member

may qualify for certain subsidies today but not tomorrow, and government

regulations can make tracking these changes a complicated process for payers.

Keeping abreast of

regulatory and coverage changes can be a challenge as well. CMS’

recent move to increase coverage of supplemental benefits is just

the latest example of the kinds of shifts plans must integrate into their

billing platforms.

Finally, Medicare

Advantage plans need to provide a smooth, easy-to-understand consumer

experience at every step of the process to

achieve high star ratings. Star ratings

assess a plan’s quality in various

areas, including member

experience

and customer service, such as its handling of member calls and questions. For

plans that cover prescription drugs in addition to health services, the rating

also covers billing information submitted to Medicare. Data

from Navigant indicate a 1-star improvement correlates to an 8% to

12% enrollment increase, which means good billing management and good customer

service around billing can be important factors in payers’ future revenue.

Benefits of a Medicare-specific platform

These challenges and

pain points are best addressed by a Medicare-specific billing platform. A

seamless, personalized process that is integrated with enrollment can streamline

payer operations while improving the consumer experience.

This is especially

important now as expectations

around customer service are rising. McKinsey has found that more

than half of consumers see great

customer service as important for healthcare companies, and they

expect these companies to make tasks easier and meet expectations while providing

a high-value service.

Good

digital tools

can help plans meet those goals and are quickly becoming a standard consumer

expectation. According to McKinsey research, an “overwhelming majority” of consumers

want digital tools to be available along the entire healthcare process. And Deloitte data show that by 2015, one in three medical care

users had already paid

a medical bill online, and more than twice that number expressed

interest in doing so.

Billing

modules that offer self-service tools can further streamline the experience for

members. A configurable, integrated billing module allows for personalized

messages, alerts, reminders and calls to action, improving engagement and plan

utilization. It also provides a single record source for member management and

reporting, with financial considerations related to SSA, RRB, SPAP, LIS, LEP

and Good Cause automatically coordinated.

Another major benefit of MA-specific platforms

is multi-state integration. No matter where the member is, the platform will

track low-income subsidies, state pharmaceutical assistance programs and

late-enrollment penalties. This allows for real-time premium adjustments based on

retroactive coverage effective dates. Member premiums for basic and

supplemental coverage are consolidated with these subsidies and penalties.

That information is then programmed into the

payer’s system and is available instantly. This helps customer service

representatives provide more informed answers to members and reduce call times.

Compliance

is another important consideration for plans, and MA-specific platforms help

payers adhere to CMS guidelines, further boosting star ratings and HEDIS

scores. This is key after payment is received, as reconciliation can be

complicated for payers if members do not pay the full balance due. Partial and

arrears payments must be allocated according to both CMS and payer rules. An

automated, configurable billing engine performs this task quickly and

accurately.

The right billing system

MA enrollment is

expected to hit an all-time high of 22.6 million next year and the

market is already extremely competitive. Seniors who encounter a sub-optimal billing

experience with one carrier have plenty of other choices.

Plans can position

themselves as the right choice with an MA-specific billing system that improves

the consumer experience while driving widespread operational improvement.

Convey Health Solutions focuses on building specific technologies and services that can uniquely meet the needs of government-sponsored health plans. Convey provides member management solutions for the rapidly changing health care world. To learn more about how the right Medicare billing system can benefit your health plan, please navigate to the Miramar:Bill webpage for more information.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

New Medicare Opioid Management Initiatives

The Centers for Medicare & Medicaid Services (CMS) held a webinar on December 27, 2018, to help providers understand the new guidance for prescribing opioids to Medicare beneficiaries – and if you didn’t listen in, you missed a good one. Here is the fact sheet for reference. My first thought was, “Can’t we just leave the older citizens alone?!” Are you really going to make all these folks with aches and pains from years of hard work jump through prior authorization, exceptions, and quantity limitation hoops? Well, in short, yes, these safety initiatives are indeed needed. The impact of addiction in the elderly can be even more dangerous than in younger patients. We also cannot forget that senior citizens are not the only demographic in the Medicare population. There are many younger folks with disabilities within the benefit who have a long life ahead of them to be free of dependency or addiction.

There

is also the problem of diversion. If a senior appears to keep losing her

Vicodin®, is it really she? Or is someone with access helping

themselves to meds from the medicine cabinet in the bathroom? We seem to spend

a lot of time and effort on “child proofing” our homes and products to keep our

children safe. We should also make sure excess and unwanted controlled

substances are not available to help with circumventing diversion issues.

But

back to the seniors. I also think there is definite need for safety

considerations. We know that opioids cause respiratory depression, drowsiness,

and constipation. These can be lethal side effects for a group whose lungs may

not be working well and are already primed for falls due to the effects of age

on balance. Constipation, causing straining on the toilet, can be a real killer

for those with cardiac ailments. Seniors are also at risk for the deleterious

effects of concomitant usage of benzodiazepines and opioids. It is important to

help educate beneficiaries of the harm that can be caused at the time they pick

up either drug at the pharmacy. I believe the new opioid prescribing guidance,

while a little more work, is a step in the right direction for safe use in

seniors and prevention of diversion.

The

presentation highlights hinged on a three-pronged approach to the rampant

opioid abuse problem – prevention, treatment, and data utilization. I will

mainly talk about prevention and the myths attached CMS endeavored to dispel.

And as always, unintended consequences will be pointed out so practitioners can

be ready to meet them head on should they arise. It should be noted these new

guidelines will not apply to any beneficiaries residing in long-term care

facilities or who are receiving hospice, cancer, or end-of-life care. Patients

receiving medication assisted treatment (MAT) for dependency such as

buprenorphine or methadone will also not be affected by the new guidelines.

Prevention methods are based mainly at the point of service. They include soft edits and an optional safety hard edit. Soft edits will include a seven-day supply limit for initial fills of opioid medications in the opioid naïve. Opioid naïve is defined as anyone who has not received an opioid medication within a minimum of a 60- day look-back period. CMS 2019 Medicare Part D Opioid Policies: Information for Pharmacies suggests a look-back period may generally be considered to be 60 to 90 days. This makes sense as immediate pain relief needs must be met but should not prime the patient for dependency by providing an extra supply. Another soft edit to be utilized is a flag when cumulative daily doses reach 90 morphine milligram equivalents (MME). An override may be provided by the plan if the pharmacist knows the beneficiary is part of an excluded group or if there has already been a provider consultation. When there are no previously known exclusions or provider consultations, the provider must be informed before an override edit can be used to fill such prescriptions. The consultation is important as the prescriber of the drug pushing the beneficiary over the threshold may not realize the beneficiary is receiving opioids from other providers. This offers the opportunity for earlier intervention before the MME creeps up to cause greater tolerance, dependency, and greater taper and withdrawal problems. Discussions should always be documented to include date, time, name of provider, and short note confirming prescriber’s intent for the beneficiary to receive dosage in question. Number of attempts to reach the provider should also be recorded. Two very important soft edits are the opioid/benzodiazepine use flag and duplicate long acting opioid drug usage. And finally, CMS is allowing an optional hard edit at 200 MME or greater cumulative daily dose. The combination of these safety and prevention edits will keep seniors safer and perhaps lessen diversion of these dangerous drugs.

Anytime

there is a guided change in prescribing habits, practitioners may worry they

are not following guidance and laws to the extent necessary. This can result in

the pendulum swinging too far the other way and prescribers becoming too

restrictive. CMS has taken great pains to address head-on misconceptions about

the new guidelines. The first “myth” they dispel is that all beneficiaries will

only be able to receive seven days of an opioid at a time. Again, this is only

for opioid naïve patients. And in the case of a beneficiary needing longer

therapy, perhaps from a complex surgery or other trauma, the prescriber and/or

beneficiary can request a coverage determination for receipt of a longer

duration of therapy. The second “myth” to be addressed is that CMS is forcing

all beneficiaries to taper or lower their opioid intake below a certain

threshold. There is no such intention on the part of Medicare. The intent is to

have beneficiaries receive the pain therapy they need at the lowest and safest

effective dose, which includes care coordination between providers and close

regard for all other medications being taken at the same time. And the last “myth”

is that Medicare is effectively tying the hands of prescribers when their

patients may need higher dose therapy. If a patient is in need of higher dose

therapy, the physician should request a coverage determination and attest the

dosage is medically necessary. CMS does not want to see their beneficiaries

miserable and in pain but rather have them, along with their providers, make

informed decisions on effective and safe therapies.

There

are always unintended consequences. Whenever I think of frail beneficiaries

whose first language may not be English and then juxtapose them with “coverage

determinations” and “appeals,” my mind is boggled. These beneficiaries may not

have the competence or patience to effectuate these patient rights, resulting

in foregoing much needed therapy. It will be important for prescribers and

pharmacists to keep an extra eye out for these beneficiaries to ensure they

receive the pain therapy they truly need. And let’s talk about those

pharmacists and prescribers! They are both overburdened and overwhelmed by the

requirements of hundreds of health plans, the dearth of time that can be

devoted to an individual patient, and having to do more with less in this time

of escalating healthcare costs. CMS states prescribers should make every effort

to take pharmacist calls in a timely manner to prevent delays in receiving

medications and to make the new guidelines work effectively. It is the desire

of every medical practitioner to be able to make care coordination expeditious

and efficient. We may have a ways to go, and I look forward to the continued

creative thinking needed to firm up the “team” concept so all manner of

practitioners can get the information they need to attend to their patients in

a timely manner. There are always challenges with new programs, but I believe

CMS is taking the lead in helping to lessen an opioid problem that has been

growing steadily over the last 10 years.

Gorman Health Group also takes the lead in providing healthcare consulting and has a bevy of creative thinkers. We can help you logically think through and operationalize the new opioid guidelines. Contact us to get this done so our Medicare programs can be the guiding light for other commercial health plans to follow!

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

HHS Proposed Bill Could Revolutionize Current Rebate Pricing Model

Removal of Drug Rebate Safe Harbor Protection

The U.S. Department of Health and Human Services (HHS) issued the proposed rule to remove the safe harbor protection rebates involving prescription pharmaceuticals on January 31, 2019.

The proposed rule is looking to disrupt the current incentive structure of the drug payments, particularly to Pharmacy Benefit Managers (PBMs). The Administration believes the proposed regulation would “…create incentives to lower list prices and reduce out-of-pocket spending on prescription drugs” and described the proposal “… to be the most sweeping change to how Americans’ drugs are priced at the pharmacy counter, ever, by delivering discounts directly to patients at the pharmacy counter and bringing much-needed transparency to a broken system.” In theory, I do not disagree but the question we always ask is what the downstream or unintended consequences are. Let’s look at a few of the details.

The

existing discount safe harbor would be amended to exclude reductions in price

paid by drug manufacturers to plan sponsors under Medicare Part D or Medicaid

managed care plans, either directly or through PBMs. Currently, drug companies

will negotiate with PBMs (on behalf of plan sponsors) for rebates off the list

price to achieve a lower net price, in exchange for volume or market-share

criteria and often for an advantageous formulary placement. But who benefits from these rebates – well

the PBMs for sure and plans pay less than the list price. Rebates are usually paid to the PBM after the

transaction at the point-of-sale (POS) and are usually not passed on to the member-

at least directly. Some will argue that the

premiums are kept down in part- from the rebate savings.

Creation of New Safe

Harbor Rules

The

proposal would create two new safe harbors, the first one would protect

discounts offered to patients at the pharmacy counter, as long as three conditions

are met:

- The

reduction is price must be set in advance with the plan sponsor under Medicare

Part D, a Medicaid MCO, or a PBM. CMS proposes that “set in advance” would mean

that the terms of the reduction in price would be fixed and disclosed in writing

to the plan sponsor under Medicare Part D or the Medicaid MCO by the time of the

initial purchase. - The

reduction is price may not involve a rebate, unless the full value of the

reduction in price is provided to the dispending pharmacy through a chargeback.

CMS is defining “chargeback” as a payment made directly or indirectly by a

manufacturer to a dispending pharmacy so that the total payment t the pharmacy

for the prescription is at least equal to the agreed upon price in writing. CMS is seeking comments to this definition. - The

reduction is price must be completely reflected in the price the pharmacy

changes to the beneficiary at the POS. This price reflection would enable the

dispensing pharmacy to have the necessary information to appropriately charge a

beneficiary who owes coinsurance, even if the manufacturer ultimately tenders

the dispensing pharmacy a payment through a chargeback to reflect this

negotiated price with the payor.

The

second safe harbor would protect certain fixed fee arrangements between

manufacturers and PBMs if the following conditions are met:

- The PBM and the pharmaceutical manufacturer must have a

written agreement that: (i) covers all of the services the PBM provides to

the manufacturer in connection with the PBM’s arrangements with health

plans for the term of the agreement, and (ii) specifies each of the

services to be provided by the PBM and the compensation for such services. - Compensation paid to the PBM must: (i) be consistent

with fair market value in an arm’s-length transaction; (ii) be a fixed

payment, not based on a percentage of sales; and (iii) not be determined

in a manner that takes into account the volume or value of any referrals

or business otherwise generated between the parties, or between the

manufacturer and the PBM’s health plans, for which payment may be made in

whole or in part under Medicare, Medicaid, or other Federal health care

programs. - Fees cannot be determined in a manner that takes into

account the volume or value of any referrals or other business generated. - The PBM must disclose in writing to each health plan

with which it contracts at least annually, and to the Secretary upon

request, the services it rendered to each pharmaceutical manufacturer that

are related to the PBM’s arrangements with that health plan and the

associated costs for such services.

Impact on the Pharma/PBM

Industry

- The

system would develop a new type of per-prescription, plan specific rebate or retail

discounts applied at point-of-service (POS). - PBMs

and plans would prefer a product, portfolio of products, or therapeutic

category with the lowest net price rather than the largest rebate. - Formulary

placement would be determined by net discounted price, the number of

competitors, and other factors. When comparing two comparably priced drugs, the

incentive to select the one with the high-list/high-rebate over the lower list

price drug is removed. - Increasing

the list price by drug manufacturers for a drug to offer a larger rebate in

order to obtain better formulary placement would be eliminated. - Price

increases to list price could be limited to current business and economic

conditions.

Impact on Medicare

Advantage

- Impact

on plan bids would see the removal of the drug rebate pool from a plan’s

revenue stream, eliminating the use of those dollars to buy down premiums or

cost-sharing. - Plan

benefit design would change in favor of high utilizers who would experience a

great POS rebates translated as lower cost-share. The greatest impact would be

on the high-dollar/high-rebate drugs such as specialty and brand name drugs. - Direct

and Indirect Remuneration (DIR) reporting would be impacted. Although the

proposed change has not yet been sufficiently developed to understand the real

world impact, based on the current reconciliation model, reinsurance subsidy

would be impacted. - The

Star Ratings impact CAHPS scores is a wild card. If most members experience

increased premiums and cost-sharing, masses of dissatisfied members unhappy

with their plans are a likely sequelae.

Summary

How this all shakes down, and

when is to be determined. The goal is to create incentives to lower list prices

and reduce out-of-pocket spending on prescription drugs. But, getting from

where we are now to achieve this goal is not a simple path. Let’s face it, all

entities impacted are in the business of making money and when squeezed in one

area may look to recoup in another.

Even the Administration

appears to be uncertain about the downstream effects of the AKS safe harbor removal

and has stated as such in the proposed rule.

Actuarial analysis have predicted savings or $190 billion to losses of

$100 billion in rebate dollars. They acknowledge the complexity and uncertainty

of stakeholder behavior. CMS is open to

comments regarding the proposed rule and the aggressive timeline proposed.

Tips for 2020 Product Development

It’s the middle of January, and the Medicare Advantage (MA) world now knows whether you were a winner, loser, or maintaining status quo from the 2019 Annual Election Period (AEP). This last year was a great one to test the waters with strong benefit strategies and aggressive sales and marketing techniques. We saw several of our clients really dig deep into their benefits and products to get aggressive and push their actuaries to really get the best products possible, and the results were definitely positive.

Going into benefit planning for 2020, there are a few ideas you should be considering:

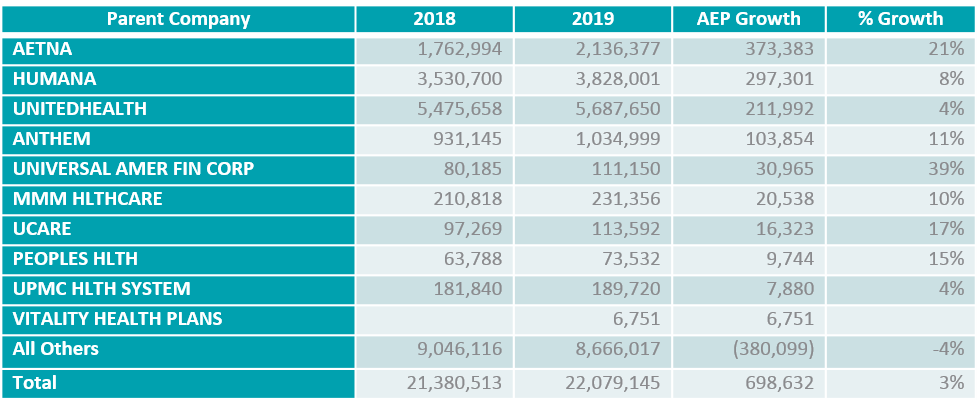

- Chances are, this will be another year where reimbursements are higher, and it is critical to ensure you are as competitive as possible. If you cannot work within your current products, look to build a new one! From a national perspective, the Medicare population is moving to lower premium products – but they still expect all the bells and whistles. When taking at a quick look at the AEP results, there were many plans that did not grow or their growth was minimal. The following shows the top 10 plans with member growth and then all others.

Although the top three plans have amassed the most membership, there is still real opportunity for growth if you go about it with the proper planning.

- Do you have a growth strategy? Plans today should not just be looking at product and benefit development from a short-term perspective. You should have a continuous growth strategy in place for your products and plans. Product development should not just be a January to June exercise. It should be part of a continuous process that allows you to understand your market, what your members and prospects need, and how to maximize their health and your profitability. Gorman Health Group (GHG) recommends a continuous three-year strategy be in place.

- Are you taking advantage of the new benefit opportunities for 2019? GHG will be developing a more comprehensive look at benefit and AEP results, but in looking at the opportunity for new and innovative ideas to either affect savings from the benefits (for members with chronic conditions) or use them to attract new membership or just to keep your members at home instead of in the hospital, now is the time to be researching these types of benefits for your products. Are you looking at the right data to understand what your market needs? Here are a couple of benefits being offered by HMOs across the country:

- Additional meal delivery

- Bundling of benefit with a dollar cap to allow members more flexibility to personalize benefits

- In-home support

- Palliative care

- Support for caregivers

- Assistive devices for home safety

- Adult day care

- Housekeeping

- These are just a few of the many benefits now being offered by MA plans.

- Last But Not Least: Medicare is not the “Field of Dreams” – just building the best product doesn’t mean they will come. MA plans today must ensure their sales and marketing strategies are just as strong and buttoned up as their product and benefits to be successful. Product, Marketing, and Sales should be planning together on building products that will resonate with the market and planning how to best promote and sell in the marketplace.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

Modernizing Part D & Medicare Advantage to Lower Drug Prices

The Centers for Medicare & Medicaid Services (CMS) has done it again. While everyone was still in a turkey-induced coma after Thanksgiving, they released a 185-page document of proposals/bombshells called Modernizing Part D and Medicare Advantage to Lower Drug Prices and Reduce Out-of-Pocket Expenses. The document provides proposals that will help contain costs for both the Part D benefit and the drug spend portion of the Part B benefit. To put some context to the magnitude of this document, CMS stated “Assuming an average reading speed, we estimate that it will take approximately 7.6 hours for each person to review this proposed rule. For each entity that reviews the rule, the estimated cost is $816”. Holy cow, that’s a lot of hours and money for one document!

After shaking off the tryptophan and diving into the document, I came away thinking the majority of these proposals could really work! Some of the proposals are in areas that historically CMS has considered to be “hands-off.” These recommendations will add flexibility to Part D health plan administration and will even give a bit of relief to beleaguered pharmacies that see their reimbursement rates ever diminishing. And, as always, there may be some negative unintended consequences. So let’s take a look at the areas with major ramifications: Protected Class Drugs, Part B Step Therapy, Real Time Benefit Tool, Negotiated Price Definition, and Referencing Lower Priced Drugs on EOBs.

The Protected Class (PC) drug proposals are mind blowing. This is truly an area that has been “untouchable” since the inception of the benefit. The first PC drug proposal is for unrestricted usage of utilization management (UM) to include step therapy (ST) and Prior Authorization (PA) for indication. CMS makes a big point of saying PC guidance should apply to PC “indications” and not just the drug entity. So now plans will be able to cover a drug, for example, for its seizure indication but not for its migraine headache indication. This aligns with their next step in developing indication-based formularies. The second proposal to not require “me too” or “follow on” drugs that pharma develops will also go a long way to contain costs. The document uses an example of a manufacturer that took its original formulation off the market and followed on with a more expensive formulation of the same drug entity that did not represent a unique administration route. Plan sponsors will no longer be required to have these types of drugs on formulary.

CMS intends to allow plan sponsors to remove a PC drug from their formulary if the drug price inflation exceeds the Consumer Price Index for all Urban Consumers (CPI-U) at any time during specified time frames. (The CPI-U is a measure of inflation over time of consumer goods and services prices.) If the drug exceeds this pricing threshold one week, and then the price bottoms out the next week, it will still be eligible for exclusion. CMS points out this is not meant to withhold drugs from beneficiaries but rather give plan sponsors a leveraging tool to work with pharma to receive better rebates on PC drugs. PC drugs have never received the rebate percentages non-PC drugs have enjoyed. So the combination of pricing thresholds and the allowance of UM techniques with PC drugs should help make pricing more competitive as manufacturers vie to get their products on formulary at a preferable tier with limited UM.

ST in Part B and Medicare Advantage Prescription Drug (MA-PD) plans is re-visited. CMS has helped to answer some of the questions of how Part B ST is to be operationalized. The biggest confusing hurdle was the time frames for decision-making. Organization determinations (Part B) have longer decision-making time frames than coverage determinations (Part D). CMS has proposed to change regulations so Part B drug decision time frames will be the same as Part D time frames. This will go a long way to help beneficiaries get their Part B drugs in a timely manner.

The Part B and Part D comingling will be easier for MA-PD plans that already have a Pharmacy & Therapeutics (P&T) Committee in place. MA-only plans will now need to develop and utilize a P&T Committee if they plan to use ST. CMS requires that any time UM techniques are employed, like ST, a P&T Committee review and approve the UM based on sound clinical judgement.

Some unintended consequences of these proposals? For Part B drugs, beneficiaries will now need to go through the exceptions process to get their Part B drug if it is subject to UM and the beneficiary has not satisfied that UM. Previously, beneficiaries just automatically received whatever Part B drug their provider requested. CMS claims all stakeholders are now familiar with coverage/organization determinations, appeals, and grievances, and these processes are a safeguard for beneficiaries to get what they need. My thoughts are the frailest of beneficiaries may actually be harmed. There will still be beneficiaries who don’t understand these processes or don’t have the patience for these processes and will simply decide to forgo therapy – and now this will occur on both fronts: Part B and Part D. There is the potential to increase medical services such as urgent care and hospitalizations as an unintended consequence. This scenario would also apply to the new PC UM allowances.

In thinking about the CPI-U price threshold proposal for PC drugs, it appears pharma may at times be unfairly disadvantaged. Price increases in raw materials pharma has no control over and that might greatly exceed CPI-U will affect drug pricing. There may be times when a drug price increase is warranted through no fault of the manufacturer. It seems as if they will be punished for something they have no control over. I would feel worse for pharma if they hadn’t recklessly and, in some cases, gleefully raised prices to extremes in the past.

A Real Time Benefit Tool (RTBT) would be a dream come true for providers. Plan sponsors would develop the RTBT to integrate with provider e-script and electronic medical records software. This tool would provide real-time, patient-specific beneficiary information such as copayments, formulary status, benefit phase, and therapeutic alternatives. Providers would be able to make better informed therapy choices in conjunction with the beneficiary, and the beneficiary would not have to wait until the pharmacist spun the copay “wheel of fortune” to know what the cost of therapy would be. The dream turns into a nightmare when you start considering the momentous money and effort that would be needed to operationalize the tool by January 20, 2020. CMS estimates putting together one of these tools would cost between $2.1 and $4.2 million. This dollar amount does not include the cost of maintaining the tool further down the line. If CMS intends to put this proposal into effect by January 2020, then plan sponsors need to tell their IT departments to immediately drop what they are doing and get moving on this new tool proposal.

CMS also proposes changing the definition of “Negotiated Price” within regulations and guidance. Currently a negotiated price is to include all rebates and price concessions that can be accounted for but NOT those concessions that are determined after the point of sale of the drug. Pharmacies may receive additional reimbursements to lower the cost of a drug based on performance. These reimbursements are determined after the end of the coverage year, and research shows most pharmacies do not qualify for them. This means the reimbursement amount at the point of sale is artificially inflated. CMS is proposing to change the definition so the negotiated price reflects the absolute minimum price – or worst price scenario –a pharmacy could be reimbursed for any drug.

Plan sponsors and pharmacy benefit managers (PBMs) would use pricing tables based on the lowest possible reimbursement into their claims processing systems that interface with contracted pharmacies. This is beneficial on a number of levels. Pharmacies can now project revenues and develop budgets based on the minimum reimbursements that could be received. This allows for more accurate projections and fewer budget shortfalls.

Beneficiaries will now pay co-shares based on a lower drug price. Beneficiaries will progress through the benefit phases more slowly, which may prevent beneficiaries from entering the Catastrophic Coverage phase. This saves CMS money as they are responsible for 80% of drug costs in this phase. So what’s the down side? The plan sponsor and PBMs will not be able to report Direct and Indirect Remuneration (DIR) at the end of the year to increase profit margins.

Many performance, volume, and market share rebates plan sponsors and PBMs enjoy are only determined at the end of the coverage year. These rebates are then reported as DIR. The DIR dollars add to profit margins which then allow for lower premiums and lower cost of benefit administration for the upcoming coverage year. In essence, bids are lowered each year due to the amounts of DIR reported. The DIR percentages for pharmacy price concessions reported have increased exponentially year over year since 2010. Using pharmacy concessions in this manner puts smaller plan sponsors (who do not have as large DIR reports) at a disadvantage for bid pricing and does not accurately reflect the cost of the drug benefit portion of the health plan. Plans will still report when they give drug pricing rebates based on these end of year concessions but now will be reporting negative DIR.

And lastly, CMS is proposing to have plan sponsors include lower cost formulary drug alternatives on beneficiaries’ Explanations of Benefits (EOBs). A specific field has been proposed to show this lower cost alternative and what the beneficiary might save. CMS is suggesting not only the popular brand to generic switch but also therapeutic substitutions that may have the same copay but a lower negotiated price. Therapeutic substitution includes a different drug that is not within the same category or class but has a medically accepted indication for the condition being treated. This is a first for CMS who in the past has not typically embraced therapeutic substitutions in its guidance.

How does the plan determine therapeutic alternatives? CMS will not require patient specifics be taken into account such as co-morbidities, allergies, etc. Example: A beneficiary currently taking valsartan will see a notation that Lisinopril is cheaper. The patient had already tried Benazepril and developed a cough. The patient may call or visit the doctor with this new information not knowing that Lisinopril will no doubt cause the same cough. Does this waste medical practitioners’ time or cause the beneficiary to make an unneeded doctor visit and copayment? This may be an unintended consequence of this proposal.

Perhaps we have all been lulled into a false sense of complacency with the Part D drug benefit. The times they are a-changin’, and plan sponsors and PBMs should hop on board with these proposals to help contain ever-increasing costs of administering drug benefits. Feeling confused and overwhelmed? Call Gorman Health Group – we’ve already spent the 7.6 hours and $816 per person reviewing the document and can help you operationalize the coming decisions.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

Changes Are Ahead for C-SNPs and D-SNPs

The Centers for Medicare & Medicaid Services (CMS) announced yesterday that beginning in 2020, all current Chronic Condition Special Needs Plans (C-SNPs) must submit their Model of Care (MOC) to CMS annually for evaluation and approval by the National Committee for Quality Assurance (NCQA). The approval will last for one year, and plans must continue to resubmit their C-SNP MOC annually for review and approval. The annual MOC submission and approval does not apply to Dual Eligible Special Needs Plans (D-SNPs) and Institutional Special Needs Plan (I-SNPs), at least not yet.

CMS also announced they will implement a minimum scoring benchmark system for each C-SNP MOC element. Plans will be approved only if they achieve the minimum scoring benchmark for each element. CMS will also propose rulemaking to implement the minimum scoring benchmark for D-SNPs and I-SNPs in 2021.

These updates represent significant changes to both the C-SNP MOC submission and scoring processes that will impact all current and new C-SNPs going forward. The scoring changes will also have a significant impact on D-SNPs and I-SNPs if CMS moves ahead with rulemaking to adopt the scoring benchmark across all SNP MOCs in 2021.

There is no time like the present to start identifying process changes that need to be made to support the upcoming requirements. If your organization would like to discuss how Gorman Health Group can assist with your preparations, please contact us at ghgadvisors.com.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

It's the Most Wonderful Time of the Year...To Think About Your 2019 CPE Audit

For most Plan Sponsors, the holidays are not a time of respite or reflection; they are a time for looking forward to the upcoming calendar year. This is when Compliance begins its tradition of annual audit work plans and getting those audits approved via committee and the governing body. While in the midst of all this planning, it’s important not to overlook your annual compliance audit.

As you know, the Centers for Medicare & Medicaid Services (CMS) requires that Plan Sponsors annually complete an independent audit of their compliance program effectiveness (CPE). Ensure you include this audit in your work plan as well as allocating the funds in your budget for an external resource. Gorman Health Group can help! We conduct these audits following the CMS audit protocol methodology. Current protocols dictate:

- Document review

- Interviews

- Tracer samples (6)

- Training/exclusion monitoring samples (20)

We can tailor this process to best fit Plan Sponsor needs. Though CMS requires the annual audit, they do not dictate its methodology. Contact us today to learn how we can support your compliance program audit needs.

Gorman Health Group has years of experience performing in-depth CPE assessments as well as audits using the CMS protocol methodology, and many of our subject matter experts are certified by the HCCA and AHIP. Contact us today for more details.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

Key Components in Shared-Risk Pool Reporting

When a team works well together, the members collectively accomplish more than any of the individuals could have accomplished alone. Certainly we have proven that adage true in healthcare as can be seen with the success of integrated delivery systems, Independent Physician Associations (IPAs) and Accountable Care Organizations (ACOs), as well as providers teaming up with other providers on initiatives such as the bundled payment program. As health plans continue adapting to the growing influence of clinical/quality and value-based care and reimbursement, building an effective patient management workflow along with financial reporting systems between plans and providers engaged in risk arrangements has never been more important.

In order to effectively manage risk dollars we have to first manage our patients in real time. We need to continue to strive towards effectively managing where our patients are at a particular point in care, what services they are currently receiving and by whom, and what their next step is in the care continuum. It is a balancing act in juggling disparate electronic health records (EHRs), an outcropping of new vendors, and community-based services providers who are new to managed care. While we continue to put patient care first, against a backdrop that still has not found the perfect solution, we need to design and implement metrics that can be meaningful and measurable to ensure the care solutions we are implementing are working clinically while reducing the total cost of care over our population.

The key components to any successful risk-based or percentage of premium contract are transparency and timeliness in reporting. Without transparency, there can be no trust in the relationship, and without timely reporting, we are unable to elicit change in a meaningful time frame. Effective management reports prepared on a periodic basis should address provider budgets versus actual performance under risk-based agreements. Baseline items to review are:

- Allocation (Revenue)

- In-Network Claims

- Out-of-Network (OON) Claims

- Incurred But Not Reported (IBNR)

- Reinsurance and Stop Loss

- Per Member Per Month (PMPM) Budget

- Administrative Charges/Fees

In addition to the above, plans and providers should have a clear delineation of financial responsibility, contract terms, operational items such as authorization process, and all state and federal compliance requirements. As relationships develop and expand over various populations and lines of business, your reporting models should be consistent, scalable, and reduce the administrative burden on the providers. At the same time, with the continued issue of data integrity, shared risk is also a perfect time for providers to step up and support their health plan partners by providing current provider and practice information. The improved member satisfaction that comes with correct information will be a win-win for both sides.

At Gorman Health Group, we can provide the cross-functional expertise you need to help your health plan team and providers be exceptional.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Preparing Your Care Management Team for Optimal Performance

As many plans are preparing to write a new Model of Care (MOC) for a new service area, an expanded service area, or redlining or revising an existing document, many plans miss the opportunity of evaluating the readiness of their Care Management team for change. The critical part of this team? The leadership.

I would like to challenge you as a leader of a care team or a care team member to think about the following and investigate or discuss these topics within your own organization:

Team Overview and Participants: Do you have the right design, or is a new design in order? Does your team have the right leadership? If so, does the leadership challenge the care team design by:

- Ensuring all lines of communication are open? This requires reviewing not only the data flow internally but also by spending time with the actual care team process and observing each and every person who touches your members and how effectively they carry out their roles.

- Establishing the correct protocols for care plan interventions? Many Special Needs Plan mock and CMS audits identify issues where the care team does not effectively identify the right intervention for the right member need. This can include associating a correct measurable outcome to the intervention. Often, systems auto-populate suggested interventions or suggested outcomes, but what really needs to happen is frequent, detailed review of the care plan content and how the members of the care team are associating outcomes and their due dates. Are they realistic? Are the time frames too far away from the actual identification of the need for an intervention?

- Establishing effective use of information and data points? How do you as a care team leader ensure your care managers, social workers, and care navigators know how to use or interpret lab or pharmacy data, not to mention where to find the data? As a care team leader, be sure to review all data sources from an IT perspective, that the data feeds are timely, and that staff knows how to interpret and use what they have access to.

- Ensuring community resources are appropriately identified? Many care plans miss the simple and free connections to community-based resources. The typical meals or transportation are often covered, but what about the more difficult items such as the actual office location where the member can obtain rental income assistance OR where is the address in the care plan/care plan notes that identifies the community loan closet where the member can obtain a raised toilet seat as it may not be a covered benefit? As their leader, help your care teams learn by ensuring they have the most up-to-date access to what they need when it comes to using community resources as, sadly, these connections could make a difference in whether a member is able to stay home and keep his or her independence.

An excellent leader of a care team digs into the actual work the care team members are doing, reviews the output of the Health Risk Assessment, and how the care team members translate the findings into a real member care plan – not a system template or repeatable care plan.

Many of these items could be included in an overall MOC performance marker to ensure the care team is measured not only on how many members they care for, but the actual true content of their care plans and recognizing all the needs of the member – not just those that can be quickly pre-populated by a basic care plan or system.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe