CMS MA Proposed Rule: Star Ratings Updates

Last week, the Centers for Medicare & Medicaid Services (CMS) released a Proposed Rule allowing expanded access to telehealth services for Medicare beneficiaries, streamlining appeals processes for beneficiaries in Dual Eligible Special Needs Plans, helping CMS recover improper payments to plans based on Risk Adjustment Data Validation audits, and continuing to increase the stability and predictability for plans relative to Star Ratings.

CMS’ Star Ratings proposals demonstrate their willingness to evolve the Star Ratings program to eliminate at least some of the longstanding (and frustrating!) volatility and unpredictability within Star Ratings, which should be a welcome change for Medicare Advantage (MA) plans. Key Star Ratings proposals include:

- Implementing cut point guard rails for non-Consumer Assessment of Healthcare Providers and Systems (CAHPS®) measures to prevent cut points from increasing or decreasing excessively from one year to the next,

- Enhancing the cut point calculation methodology for non-CAHPS® measures to better eliminate the effect of outliers, and

- Enhancing adjustments for extreme and uncontrollable circumstances.

CMS also presented proposed measure changes for future Star Ratings calculations:

- Controlling Blood Pressure will be retired to display for the 2020 and 2021 Star Ratings, with a planned return as a 1x-weighted measure using the new Healthcare Effectiveness Data and Information Set (HEDIS®) 2019 measure specifications beginning with the 2022 ratings. The HEDIS® 2019 changes to this measure are substantive, including updates to reflect new hypertension treatment guidelines from the American College of Cardiology and American Heart Association and significant structural changes (including allowing two outpatient encounters to identify the denominator, allowing the use of telehealth for at least one of the denominator instances, adding an administrative approach to allow Current Procedural Terminology (CPT) Category II code collection, and allowing remote monitoring device readings for the numerator).

- Plan All-Cause Readmissions will be substantially modified by the National Committee for Quality Assurance (NCQA) for HEDIS® 2020. As a result, this measure will be moved to display for the 2021 and 2022 ratings. HEDIS® 2020 measure changes are expected to include addition of observation stays in the measure, removal of individuals with high frequency admissions from calculations, and expansion of the calculation to include all members older than 18. Small plans may benefit from the proposed changes, as NCQA is also recommending a minimum denominator of 150 in the enhanced calculations.

• The current MPF Price Accuracy measure will remain the 2020 and 2021 ratings using the current methodology, and the enhanced methodology will be used beginning in the 2022 ratings. The proposed measure updates capture both the magnitude and frequency of differences between a contract’s Medicare Plan Finder (MPF) advertised prices and the actual pricing at the point of sale.

CMS seeks feedback and input from plans regarding these proposals and will accept comments through December 31, 2018. As we always do, we strongly encourage our clients and other MA plans to provide feedback and alternative proposals to CMS. We’ll provide an update as soon as these proposals are finalized. In the meantime, if you need help with your Star Ratings program or performance, we can help. Please contact us with questions or for more information.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

Medicare Advantage 2020 Proposed Rule

It’s been a long wait since the passage of the Bipartisan Budget Act in February, but the 2020 Medicare Advantage (MA) proposed rule is finally here. Perhaps the biggest opportunity for plans is the shift that makes telehealth a basic benefit, which means the digital revolution that brought us things like ATMs on every corner, iPhones, and Teslas is finally seeping into Medicare. Plans can decide which benefits to provide via telemedicine in any geography. What is really exciting is the service can be delivered to the patient in the home. This is a tremendous opportunity to bring continuity to episodes of care that will really impact outcomes. It will also be possible for plans to offer telehealth services as a supplemental benefit. Additionally, it’s an opportunity for MA to offer new advantages over Original Medicare where telemedicine is still restricted to rural areas and the patient must be in a health facility to partake in the services.

Star Ratings are in for some changes, too. Measures with proposed changes will include Medicare Plan Finder price accuracy, all-cause readmission, and controlling high blood pressure. Additional enhancements will be made to CMS’ methodology to adjustments will be made to handle unusual situations beyond a plan’s control like the fires and hurricanes that seem to be less unusual as of late.

The Centers for Medicare & Medicaid Services (CMS) gives, but, unfortunately, it also takes. On the program integrity side, the agency proposes using extrapolation in the Risk Adjustment Data Validation audits. That is a definite cloud on the horizon for plans as the regulation predicts a return to the program of $4.5 billion for the government over 10 years. Since 2012, CMS has held extrapolation from a valid sample of records was coming, and now there is an opportunity to comment on the specific methodology that might be used. Comments on the proposed rule are due 12/31. Happy New Year.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

Inside MA-PD Premium Trends

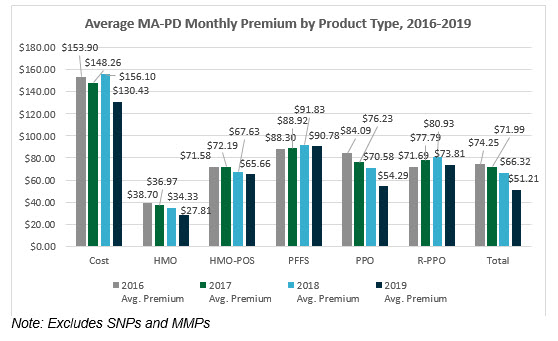

With the release of the 2019 landscape files, benefit information and Star Ratings data, now is the time to update your market analyses to understand trends in your current and potential markets. Nationwide, 2019 monthly premiums for Medicare Advantage Prescription Drug Plans (MA-PDs), excluding Special Needs Plans (SNPs) and Medicare-Medicaid Plans (MMPs), range from $0 per month to $388 per month, with the average monthly premium being $51.21. The average monthly premium of MA-PDs decreased from 2018 by 23%. While a decrease aligns with the overall premium trends since 2016, this level of decrease is unprecedented. The overall decrease in the 2019 average monthly premium is nearly four times the average premium decrease seen in 2018 (8% decrease) and seven times the average premium decrease seen in 2017 (3% decrease). Since 2016, MA-PDs have seen an overall decrease in monthly premium amounts by 31%, from $74.25 to $51.21 – a $23 decrease. How have premiums changed in your market(s)?

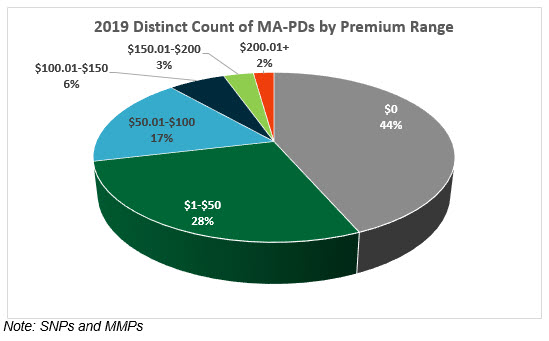

As discussed often in recent years, $0 monthly premium plans are on the rise. Notably, nearly half (44%) of MA-PDs have a $0 monthly premium. This segment saw the most growth in the distinct number of plan benefit packages (PBPs) offered with an increase in nearly 300 new $0 MA-PDs. The premium segment that saw the second most growth in the distinct count of PBPs from 2018 to 2019 is MA-PDs, with a monthly premium between $1 and $50; 28% of MA-PDs fall in this premium range, with an increase of nearly 121 PBPs. Additionally, the number of PBPs available with a monthly premium over $150 has decreased since 2016. Gorman Health Group (GHG) expects to see these trends continue.

While 44% of all PBPs are $0 monthly premium plans, over half (56%) of all Health Maintenance Organizations (HMOs) are $0 premium plans, and 75% of $0 premium plans are HMOs. We expect to see the number of $0 PBPs to continue to increase, especially in the HMO product. Remarkably, nearly 30% of Preferred Provider Organization (PPO) products are $0 premium plans. For 2019, there are an additional 124 $0 premium plan PPOs available. This is nearly three times the overall $0 PPO growth in 2018. With the growth in availability of $0 PBPs, Medicare Advantage Organizations (MAOs) will need to continue to push for innovative product design benefits to remain competitive. Even $0 premium plans need to explore creative ways to make their plans stand out in the $0 crowd.

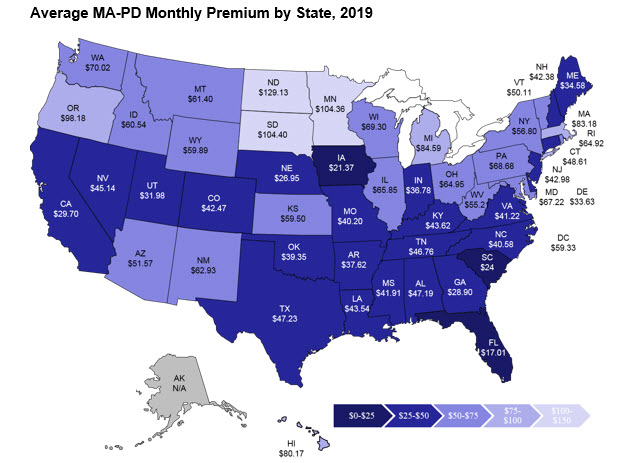

The average monthly premium by state (excluding Puerto Rico and territories) ranges from $129 in North Dakota ($129.13) to $17 in Florida ($17.01). As in years prior, the states with the highest average premium are found in the plains states region – North Dakota ($129.13), South Dakota ($104.40), and Minnesota ($104.36). This is not surprising as these states continue to have large enrollment in Cost plans, which are traditionally structured to have high premiums. For example, in 2019, the average monthly premium of Cost plans is $130.43.

So what does this all mean for you? Now is the time to replicate a similar analysis to understand your current and/or potential markets. Additionally, assess the key benefits offered, including ALL supplemental benefits. Some of these benefits include the maximum out-of-pocket, inpatient hospital cost sharing, primary care physician and specialist cost sharing, and supplemental benefits like routine dental, vision, and hearing – and don’t forget to assess plans offering targeted supplemental benefits. How do your plans stack up to the competition? Are you growth goals for this coming Annual Election Period (AEP) realistic? Are your AEP marketing and sales strategies ready to face the competition and meet growth goals – what can you adjust? What must you consider for 2020? No, it’s not too early to start planning – product and benefit development is a year-long process.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

Readiness Checklist Outlines Key Operational Requirements

The Centers for Medicare & Medicaid Services (CMS) published its annual Readiness Checklist via HPMS memo on 10/2/2018. As in prior years, the checklist provides a high-level overview of key operational requirements for the coming plan year. Plan Sponsors must communicate any at-risk requirements to their CMS Account Managers. Here we summarize important things to consider as the 2019 plan year approaches:

- CMS is phasing out the Social Security and Health Insurance Claim Numbers and moving to a Medicare Beneficiary Identifier (MBI) by April 2019. Plans must ensure all systems are ready for the transition, including any “home-grown” data repositories (e.g., appeal and grievance databases).

- CMS will be providing Medicare Advantage (MA) and Part D Sponsors access to a precluded providers list after eliminating the provider/prescriber enrollment requirement. Claims from those identified in the precluded provider list must be denied.

- The reinstituted Open Enrollment Period (OEP) not only changes enrollment time frames, it also expands customer service extended hours for 7 days a week, 8:00 am to 8:00 pm, through March 31, starting in 2019.

- Update systems, processes, and training to the new guidelines for Special Election Period (SEP) changes for dual-eligible (DE) and other low-income subsidy (LIS) eligible individuals. Beginning 1/1/2019, DE and LIS individuals will only be able to change plans one time per quarter for the first three quarters with no SEP in the fourth quarter. Many systems are automated to allow these elections to process when received, as through 2018, they are unlimited.

- Health plans should be sure to include customer service, enrollment, and appeals and grievances in their drug utilization controls for opioid management. Staff will need to have scripts and processes in place when members are placed in drug management programs that may impact their access to medication and impact potential disenrollment restrictions.

Ensure your employees are familiar with new guidance from CMS, including the Call Letter; Final Rule and Medicare Communications and Marketing Guidelines. The Readiness Checklist does not convey all guidance changes, and understanding the new rules is critical for Plan Sponsor readiness and compliance.

Gorman Health Group conducts readiness assessments for its clients to help identify any areas of risk related to upcoming plan year preparedness. This is especially important for plans new to the market in 2019. Contact us today for additional information.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

The 2019 Star Ratings Are Out!

The 2019 Star Ratings are out! While our experts crunch the numbers and analyze the data, here are a few “fast facts:”

Of the 360 contracts rated in both 2018 and 2019,

- 80 earned higher overall ratings in 2019 compared to 2018

- 90 earned lower overall ratings in 2019 than in 2018

- 190 maintained the same rating in 2018 and 2019

The more things change, the more they stay the same.

- 45% of Medicare Advantage Prescription Drug Plans (MA-PDs) (170 contracts) earned 4+ stars in 2019, compared to 44% (170 contracts) in 2018

- Approximately 74% of MA-PD enrollees are currently in contracts that will have 4+ stars in 2019, compared to 73% in 2018

- The 2019 average Star Rating (weighted by enrollment) is 4.05 in 2019, compared to 4.07 in 2018

- 376 contracts met the criteria to receive an overall rating in 2019, compared to 385 in 2018

- Humana (with 84% of its 3.5 million members in 4+ star contracts), United (with 70% of its 5.4 million members in 4+ star contracts), and Kaiser (with 100% of its members in 4+ star contracts) continue to dominate the competitive Medicare Advantage (MA) Star Ratings arena

Sponsors with the most members impacted by year-over-year changes in the overall ratings are among industry giants:

- Some of the big winners in 2019 include Cigna, Highmark, MCS, Wellcare, and Centene

- Among those with the most members in contracts earning lower ratings in 2019 are United, Anthem, and Blue Cross and Blue Shield of Minnesota

Although the Star Ratings headwinds are strong for new plans, sponsors continue flocking to MA:

- 22% of contracts operating less than 5 years earned 4+ Star Ratings in 2019, compared to 41% of contracts operating between 5 and 10 years, and 54% of contracts operating more than 10 years

- 210 contracts were not rated in 2019 because they were too new to receive a rating or did not have enough data to be rated, compared to 168 in 2018

See a trend in the Star Ratings you’d like us to comment on in our upcoming Star Ratings webinar? Get in touch with one of our experts, and we’ll address it in our webinar!

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Bundled Payments Report Issued

Bundled payments capitate medical care at the episode level. It is one of the few “value-based” approaches the Centers for Medicare & Medicaid Services (CMS) and the Innovation Center have fielded that works. But it doesn’t work for the taxpayers, at least not yet. If you stop and think about it, the whole Prospective Payment System (PPS) is basically a bundle approach. It tied together a lot of individual hospital services that used to be separately billed and gave hospitals an incentive to be efficient. And were they ever: the average length of stay dropped 17%! The newer approach expands the bundle, in some cases to every part of the episode, including physicians, hospital, post-acute, and home health. Before the Affordable Care Act (ACA), CMS ran some demonstrations that proved the concept, yielding savings a bonus for doctors, and savings for the government and the patient, too, with reduced copayments. A further expansion under the ACA was promising, so the Obama Administration jumped ahead with a mandatory program for hip and knee replacement in 66 localities. The hospitals cried foul, but many had success and enjoyed bonuses. After the 2016 election when Tom Price became Health and Human Services (HHS) Secretary, he pared back that program just as results showed it was successful.

Keep in mind Medicare spends between $16,500 and $33,000 on knee or hip cases. Average charges in total approach $50,000 in the U.S. If you are mobile, you can get it done for less than $10,000 in India!

The Lewin Group delivered a report to CMS this week on the fifth year of the voluntary bundled payment initiative that was started under the ACA's Innovation Center in 2012. As in earlier years, the great majority of activity was in joint replacement episodes, and while there was little impact on quality for better or for worse, there were savings in spending on the services. Those savings were generated by reductions in post-acute care, both inpatient and home health. Unfortunately, the government didn't get any benefit, and the providers did because it was an upside-only risk approach. The newer “advanced” Bundled Payments for Care Improvement (BPCI) initiative, which is getting started now, will put providers at risk. Sophisticated providers are ready to play in this new space. This is where health reform is happening – initiatives that align providers’ incentives with the goals of public programs. Health plans and provider groups that stay focused on CMS’ strategy will be the winners going forward.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Three Reasons to Invest in the Open Enrollment Period

The Open Enrollment Period (OEP) is back with some new rules. Starting January 1, 2019, Medicare Advantage (MA) enrollees have a one-time opportunity to switch their plan, similar to a grace period. This opportunity ends March 31. Both new MA enrollees and existing enrollees have the opportunity to switch plans. This is a new opportunity for MA plans to both win and lose enrollment! To make sure you are not on the losing enrollment side, here are a few ideas in which to invest resources and budget before the upcoming OEP.

Let Your Data Do the Talking

Recognize the power of the data available to you, and utilize that data to develop communications to new and existing enrollees, make organizational and/or operational changes to your operations, and allow this data to eventually feed into your product development process. Utilize leading indicators such as grievances, customer service complaints, rejected claims, and similar data to identify issues. Lagging indicators such as disenrollment surveys, especially if they are “real time,” provide valuable information. Continual analysis of both leading and lagging indicators can fix potential problems, identify members at greatest risk for disenrollment, and provide the basis of building an attrition model to predict members most likely to leave going forward.

Member Services and Communications need to be the Stars of OEP!

Member communication interactions (either verbal, written, or in person) could either break or win you the OEP. You still have time to review your welcome interactions with new members and your existing member communications and interactions with current members to ensure they are best in class. You may want to have member events this year so they understand the 2019 benefits – and if you have great news for them, you want to make sure they hear it. The goal is to ensure every new member knows what to do January 1 and to have multiple touches that educate, welcome, and engage members about their new MA plan. You do not want buyer’s remorse occurring at any point from the sale through the end of OEP. Existing members need to be educated about any changes in benefits, and if your data is talking to you, you will have a list of members who need “real” hands-on member service touch points. In addition, when was the last time you really looked at the communications going to your members? Are you communicating too much or not enough? Do the communications have the same tone and messaging throughout? Or are they just recycled from year to year? Has the Member Services team received training lately to make sure they are reinforcing the tone and messaging you want your members to hear and feel? Do they know the 2019 benefits and what benefits to make sure members know about? Do you listen to Member Services calls to ensure you are providing the member experience you portray in your advertising and communications? Now is the time to reassess how you are communicating with your members and make certain you are maximizing your opportunity.

Marketing Cannot Be Forgotten

Health plans are unable to market the OEP opportunity but do have the ability to market the following:

- Branding

- New to Medicare

- Education

- Medicare Supplement

Although you may not have much of a budget for marketing during the first quarter, you can utilize it effectively. Make sure you are advertising in January and the last few weeks of March. If you have educational events, advertising them digitally or though radio will help bring additional awareness to what your organization does for its members. Most plans have a very robust “New to Medicare” budget already, but you may want to invest in some free-standing inserts in January or March and/or advertise on TV. Utilize branding during this time since it puts your brand in the market during the OEP. Whatever you have the resources to do, make sure you are strategic in your efforts to make it worthwhile.

It’s Not All about Winning Enrollment

At Gorman Health Group, we are hearing many clients talk about gaining enrollment during the OEP but not so much about the possibility of losing membership. Your goal should be to ensure you have everything in place for this OEP to make certain you are on the winning side of OEP and are not giving up your membership to another MA plan that made sure they strategically invested in this opportunity!

For more information about the OEP opportunity and ways you can set up your team for success, contact me at dhollie@ghgadvisors.com.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan's investment. Click here

Why Investing in Your Staff Will Benefit Your Members

I started my career working in social services. I wanted to change the world, as many of us do in our youth. When my family needed health insurance, I applied for a job with a health insurance company. It was an unexpected career change, but I was fortunate as I had an amazing mentor who taught me a different view point of my job. She expanded my view and taught me to see the big picture of making our members’ lives better. Was I in case management? Maybe a social worker interacting with members? No, I was a customer service representative and then an enrollment supervisor. But she gave me vision of how my job touched our members and made a difference.

Mentoring is a fine art. As the talented poet Robert Frost said, “I’m not a teacher but an awakener.” Ask yourself this, no matter your position or role, can you say that? Are you a teacher or an awakener?

It is that vision and passion that makes the difference. I learned from a few key people in my career what that looks like, and it changed my world. Today, in many ways, that skill is lacking, and it is time to bring it back. As you consider your role, and that of those on your team, what can you do to awaken those on your team to be part of the bigger change to your culture and member experience?

Some suggestions that guide me are:

Always Remember: “It’s All About the Member.” I remember very early in my career a call that impacts me still today. A member called in distraught. His wife, also a member, was dying. She was in a nursing home and didn’t have long to live. Her family had made a blanket for her, and it had disappeared. Aside from it being a participating facility, it had nothing to do with our insurance. But it had a world of impact to them. I worked for a company that valued that and allowed me to follow up to make sure the blanket was found and returned to the member. I also had the freedom to take this man’s calls as much as needed.

Systems Are Tools. Automation is great. It allows us to be efficient and focus on the things that need our attention. Auto-adjudication for claims or enrollment gives us the ability to focus on the fallout that can’t auto process. What happens often is that systems replace training and knowledge. Staff no longer know “why” the system is doing something. It makes problem resolution and oversight far more challenging as often issues are not identified quickly. Process improvement and automation are amazing tools, but don’t let them replace a knowledge and training about the behind-the-scenes requirements.

Our Staff Need Us. Management is in meetings and often behind closed doors. That leaves a gap. Where does your staff go when they need help? Is it counted against them to ask for help? Does your staff feel like you understand their barriers and are working to eliminate them? Do you give them the opportunity to grow and be challenged in a supportive environment, or is it more “sink or swim”? If we really want member-focused staff, we need to be staff-focused managers.

First Call Resolution Is Only Valuable When It Is the Right Resolution. Is first call resolution more important than the right resolution? More and more I am hearing plans say they are not giving their members homework. What a refreshing philosophy. You may not be able to fully resolve an issue on the first call because more research or activity is needed to prevent that “homework.” Sometimes that is what excellent service requires.

My team includes some of the most talented, engaged people in the industry. They understand mentoring and strive to bring that to each project. A recent example is a colleague of mine. She recently worked with a client and had a location called “Katie’s Learning Lab.” Operations staff could stop in and ask questions and get clarifications when they didn’t know what to do. It gave a sense of security; there was a place to get help without judgement. Katie invested time with the staff. She gets it. She knows that until staff have a mentor to show them their place in our members’ world, it’s just a job when, in reality, it’s people’s lives. And we have the amazing ability to positively impact them.

We understand enrollment and customer service representatives as well as analysts well-versed in MA (and engagement with seniors) are in short supply in most markets.

If interim staffing to support your front line staff is what you need to ensure a successful enrollment season, GHG can enhance your team with our own mentors, providing knowledgeable, effective assistance and an eye for detail from staff with decades of experience.

Here are suggestions to ensure your team is effectively trained to make every member touch count.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Learn how a single platform designed specifically for Medicare can streamline enrollment and offer a better way to deliver a return on your plan’s investment. Click here

Streamline Your Medicare Enrollment

Large Medicare Advantage carriers invested a median of $11.25 per member per month in marketing in 2015, and spent a median of $17.44 on account and membership administration, according to a Sherlock Company analysis. With that kind of spending, the last thing a carrier needs is for seniors to become confused and frustrated by the enrollment process, but that is exactly what happens when carriers rely on technology that is not up to the task.

Pain points in the enrollment process include intake, eligibility verification, enrollment acceptance and validation, and benefit activation and notification. Each is subject to federal regulations with which compliance is paramount, and at each step, consumers can run into problems, become frustrated and abandon the process.

Many MA enrollment platforms were initially designed for use by commercial health plans and retrofitted to Medicare, and these patchwork systems make for a disjointed, unfriendly consumer experience. Applicants are dropped or told they are ineligible, benefits are never activated, or the applicant is never notified of acceptance and activation. In the age of Amazon and Apple, this is unacceptable. The MA space is extremely competitive, and seniors who encounter enrollment problems with one carrier are likely to look elsewhere.

A single platform designed specifically for Medicare Advantage with capabilities to support the full enrollment lifecycle offers a better way to deliver return on your plan’s marketing investment.

A purpose-built system should guide the user with smart wizards that make it easy for customer service and sales teams. It should minimize the possibility that eligible applicants will be rejected and handle reinstatements with ease. It must accept enrollment applications in paper, electronic and telephonic formats, all of which remain important in this market. And it must capture all CMS-mandated information, regardless of the enrollment source.

Once an enrollment application is accepted into the carrier’s system, it must be transmitted to CMS for verification. An enrollment module that identifies eligibility verification errors and flags them for repair cuts down on the percentage of applications rejected by CMS – a serious problem with patchwork systems. Ideally, avoidable rejections should be reduced to a fraction of a percent, well below the CMS 1% threshold.

After an application is validated and accepted, beneficiaries must be notified within a CMS-mandated period. The right platform should be able to handle this task, too. It must reduce compliance and quality risk and keep track of ever-evolving Medicare regulations.

A purpose-built system offers the additional advantage of bridging integration and interoperability gaps between multiple systems and processes, improving efficiency and the member experience. Systems that include a module for tracking enrollment to the marketing or broker source allow plans to identify problems and further optimize marketing for future growth.

MA plans that rely on a patchwork of modules that have been tweaked and cobbled together shortchange the enrollment process, and they risk losing customers to competitors who understand the importance of a smooth, smart and efficient process. An intuitive, compliant, end-to-end system is the solution for a better consumer experience, improved market share and far fewer administrative headaches.

Convey Health Solutions focuses on building specific technologies and services that can uniquely meet the needs of government-sponsored health plans. Convey provides member management solutions for the rapidly changing health care world. Learn more.

First seen on SmartBrief.

For information on the other solutions Convey has to offer, please follow this link.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe

Senate Approves Bill to Address Opioid Epidemic

On Monday, the Senate approved a bill to address the opioid epidemic by a vote of 99 to 1. Three months ago, the House passed their own opioid legislative package by a vote of 396 to 14. Both chambers overcame their usual partisan politics to turn 70 separate bills into a comprehensive legislative package that can be enacted before the mid-term elections. Conference discussions have already started, and the goal is to have a final package for President Trump’s signature by Friday, September 28.

While many of the provisions in the House and Senate bills are similar, there are some important differences. In particular, the Senate bill does not include as much funding as the House provisions. Experts in the substance abuse community feel both bills do not include enough money (estimated to require $20 billion a year) to make a dent in the opioid epidemic, which took 50,000 lives last year. One in three Medicare beneficiaries took at least one opioid last year—but at least it’s a start.

“Decreasing access to opioids without appropriate treatment facilities and resources will not decrease the alarming number of deaths in those patients addicted to opioids,” explained a Gorman Health Group senior consultant. “Health plans will still need to plan for alternative medications and treatment placements.”

The Senate bill costs $8.4 billion with the funds to be disbursed to multiple government agencies involved in the public health emergency. Common provisions in both bills include funds for the U.S. Postal Service to detect shipments of the deadly synthetic fentanyl drugs, most of which come from China. The bills also include funds for physicians and first responders to have access to more medications to reduce the use of opioids by addicts and provisions for fewer pills in each prescription. “The restrictions on opioid quantity and day’s supply for those new to opioids should decrease the number of addicts, but it is unclear what methods can be used to stop fentanyl, the dangerous and lethal powder coming from China." Both bills require CMS to test a bundled payment model to expand Medicare coverage for opioid treatment programs. The bills mandate electronic prescribing in Medicare Part D for controlled substance prescriptions, and both bills also include more funding for National Institutes of Health (NIH) research.

The Senate bill does not include $1 billion included in the House that will partially overturn the Medicaid Institutions for Mental Disease (IMD) exclusion, which prohibits Medicaid from paying for addiction services in certain inpatient rehabilitation settings with more than 16 beds. The Senate bill does not authorize additional Medicare funding for non-opioid alternatives for post-surgical pain as included in the House bill or the House provision to share more patient medical information. The Senate bill also does not include a provision to require Medicare Part D plans to provide drug management programs for beneficiaries at risk for substance abuse addiction and requiring Medicare and Medicaid managed care plans to implement safety limits for opioid prescriptions and refills. The Senate bill also does not include a provision allowing CMS to waive limits on telemedicine reimbursement for substance abuse and related mental health disorders.

The President is expected to sign the legislation as soon as it arrives on his desk.

Resources:

Stay connected to industry news and gain perspective on how to navigate the latest issues through GHG’s weekly newsletter. Subscribe